¶ Decentralized Finance

¶ The World Computer

Ethereum exists between a network of 1,000s of computers (nodes), each running a local version of the Ethereum Virtual Machine (EVM). All copies of the EVM are kept perfectly in sync.

Any individual EVM is a window into the shared state of the World Computer. Each node keeps its EVM in sync through a consensus mechanism - Ethereum uses a specific implementation of Proof of Stake (PoS).

Consensus is coordinated around ETH; economics incentivize actors to behave properly without explicit trust.

More specifically, the system is based around the distribution of ETH: positive behaviors are rewarded with ETH, malicious actions are punished with confiscation.

In order for consensus, and therefore Ethereum, to operate, the system must natively support property rights.

When a user choses to use the World Computer they are implicitly agreeing to respect the property rights defined by the rules of consensus:

- no user can create or destroy ETH

- transactions require the explicit signature of the account owner

- transactions cannot be reversed

¶ Programmable Money

The first class of applications that have seen rigorous development have been built on this novel property of Ethereum.

The World Computer provides property rights and a neutral environment to run code, and so it was turned towards THE financial primitive: money.

The World Computer allows code to be injected directly into financial assets. A crypto-asset can be a simple representation of value or a sophisticated, self-aware piece of technology; the only limit is the imagination (and capabilities) of a developer.

In fact, The World Computer isn't even limited by the contributions of individual developers. Just as property rights are native to Ethereum, so is the open-source principle of composability.

Everything is readable by everyone. And everyone can build on everything.

De-Fi is so audacious and complex that (at this point) even Vitalik Buterin can't wrap his head around it.

If complexity is the paradox, composability is the solution. Each builder can provide a piece of the puzzle, while others stitch the greater picture together.

De-Fi Summer, the genesis of De-Fi, was only 2 years ago; we've barely gotten things working, I can't even imagine what's coming. I mean, look what we've already achieved...

Deep Dive: De-Fi is a Better Way

De-Fi is not just about new capabilities, it's a complete financial revolution. The old ways were about opacity, implicit trust and asymmetric power dynamics. The new ways are about transparency, decentralization and fairness. And about bleeding edge technology.

Before I found crypto I worked in corporate finance at one of the 3 largest consumer goods companies in the world. The deeper you dig, the more you learn life's universal truth: nothing works, the system is barely holding together. De-Fi is simply a better way.

You don't have to take my word for it, let's roll back the tape.

¶ Case Study: 3 Arrows Capital

It's May 2022 and crypto is in the process of melting down. The moon has already crashed landed, causing massive shockwaves across the ecosystem. Though most didn't know it yet, Goliath was about to fall.

At its peak, 3 Arrows Capital managed almost $20B in crypto assets. However, in less than 1 month in 2022, the firm would collapse in destructive chaos.

The root cause: absurd leverage and poor risk management.

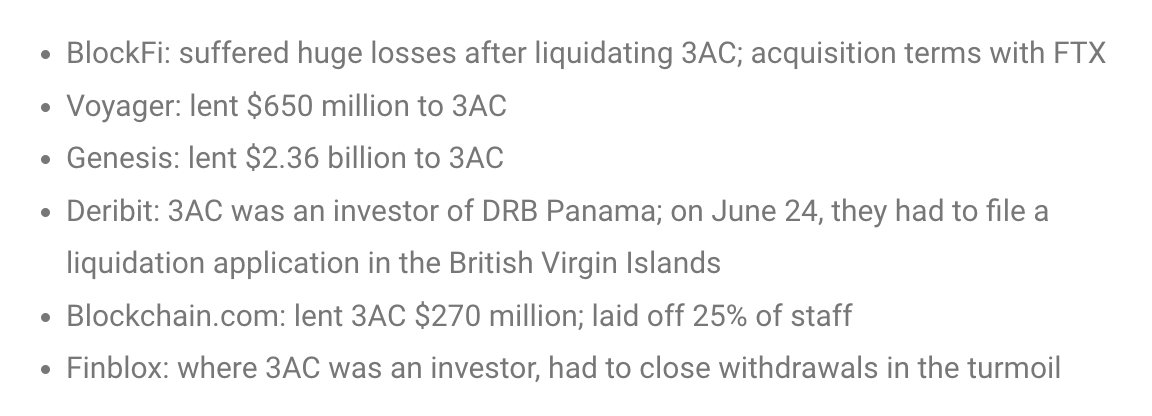

At the time of its death 3AC owed >$3.5B to >20 companies. In the end, it turned out that most of these companies had given absurdly irresponsible, unsecured loans to 3AC. They both enabled the firm to create the bubble and suffered catastrophically when it popped.

But that's what happened off-chain, in the centralized world of banks, CEXs and hedge funds.

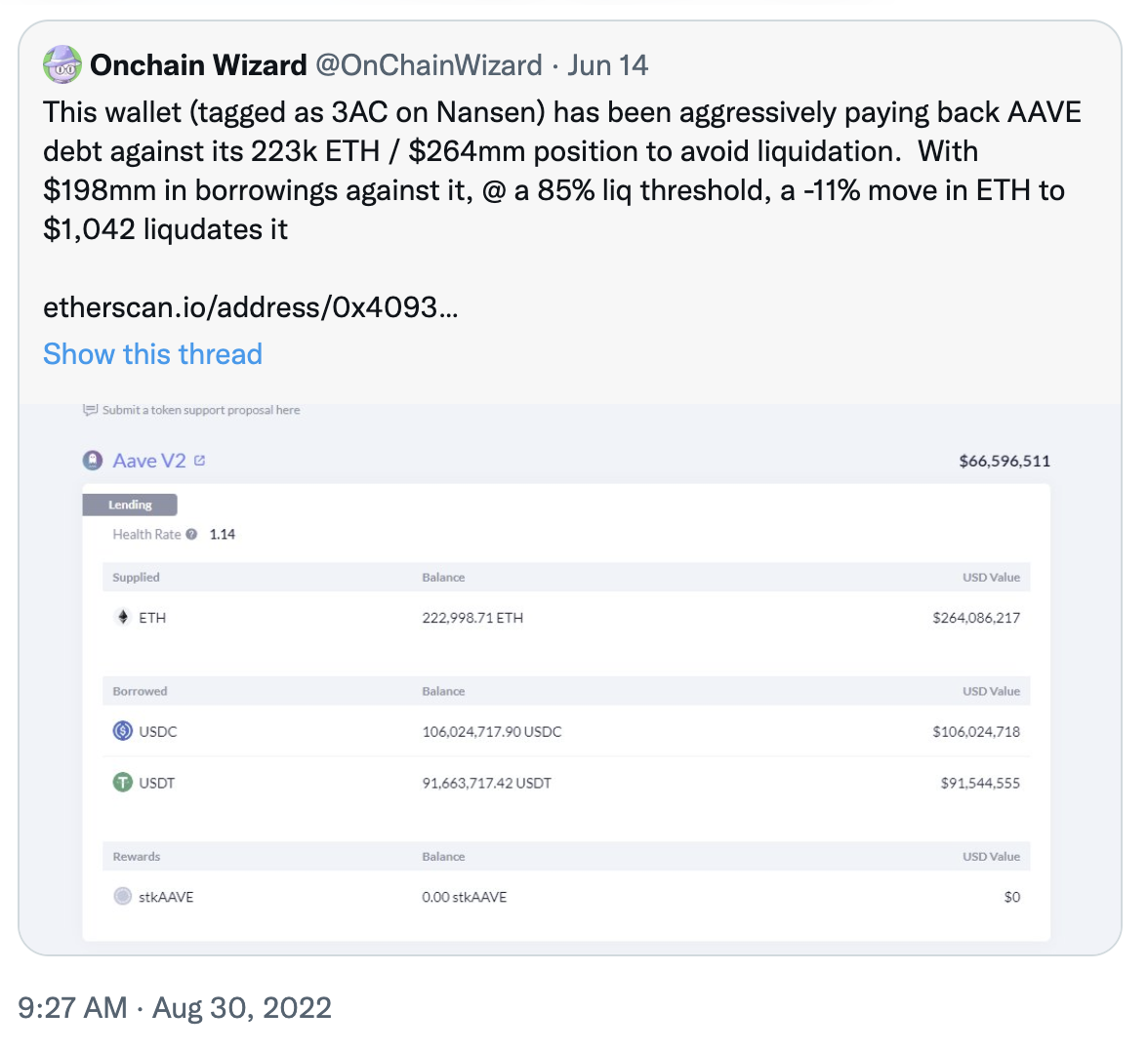

3AC had lenders on-chain too, the largest of which was Aave (holding 9 figures of debt).

In De-Fi, code is law. If Aave says "we will liquidate you at $X" they are not making a threat, they are stating a fact.

There are no negotiations. Not lawyers, lawsuits or bankruptcy. No protection.

There is simply a liquidation threshold.

And so, as the market came crashing down around them, Zhu Su, Kyle Davies and 3 Arrows Capital did one final thing before they began searching for legal (and physical) protection.

In De-Fi's perfect future, something like 3 Arrows Capital isn't supposed to happen. Losing bets that fall beneath a lender’s collateral requirements would be liquidated without mercy, and no one would be waiting around for a margin call.

Case study: Aave in June 2022

¶ The Internet Economy

Deep Dive: The Internet Economy

De-Fi will not replace Trad-Fi, it will augment it.

De-Fi can do everything that Trad-Fi can do, but it can do it transparently and can do it better. And, more importantly, it will open up an entirely new area of economic activity:

The Internet economy.

De-Fi is still so young, we have so much more to build.

Today, we have a budding platform that emulates our real-world financial systems. This is the starting point.

The next step?

I have some ideas, but who am I?

Well, you tell me!

What are you building?

¶ Resources

Source Material - Twitter Link

Source Material - PDF