¶ Programmable Money

¶ Money Throughout History

Money is a concept older than history; by 2008 it had permeated our lives so deeply that it’s hard to understand the world without reference to it.

Over all that time, money has basically flipped between being backed by shiny metal or government threats.

In 2008, as the modern financial system collapsed, Satoshi Nakamoto published the Bitcoin whitepaper.

A couple years later, Blizzard nerfed siphon life and so Vitalik Buterin created Ethereum in retribution.

Bitcoin is the promise, Ethereum is the delivery.

¶ The World Computer

The goal of blockchain technology is to create a computing environment using a decentralized, trustless network.

A credibly neutral network.

Bitcoin is a simple machine that has accounts and balances, and can process transactions that send value between them.

Ethereum is a general purpose computer.

That’s how you should understand Ethereum: the World Computer. A shared utility, running across a global network of untrusted nodes, economically secured by ETH.

Why?

- anyone can build on it, and anyone can build on top of anyone else’s work

- it provides internet-native money

Building on The World Computer requires a focus on Composability.

¶ Composability

A highly composable system provides components that can be selected and assembled in various combinations to satisfy specific requirements (both current and future).

For example, take tokens: conceptually, a token is just an app running on The World Computer.

Imagine 1,000s of coders creating bespoke apps that they call tokens. Exchanges would have to carefully integrate each one, one at a time.

Forget De-Fi entirely.

Instead, token standards provide the template upon which developers can build. These templates provide the properties and characteristics that one must have in order to be considered a token.

All a dev needs to do is fill in these functions and hit deploy.

By conforming to a token standard, a token can immediately access a ton of De-Fi protocols (also World Computer apps):

- LP/swap on Uniswap

- Lend on Euler Finance

- Trade on LooksRare

All without any custom integrations; the apps already know how to communicate.

¶ Programmable Money

But this isn’t just about easy development and access to marketplaces. This is about creating programmable property, assets and money.

Lending protocols and AMMs came first because they have direct corollaries in the real world.

What’s interesting is what came next…

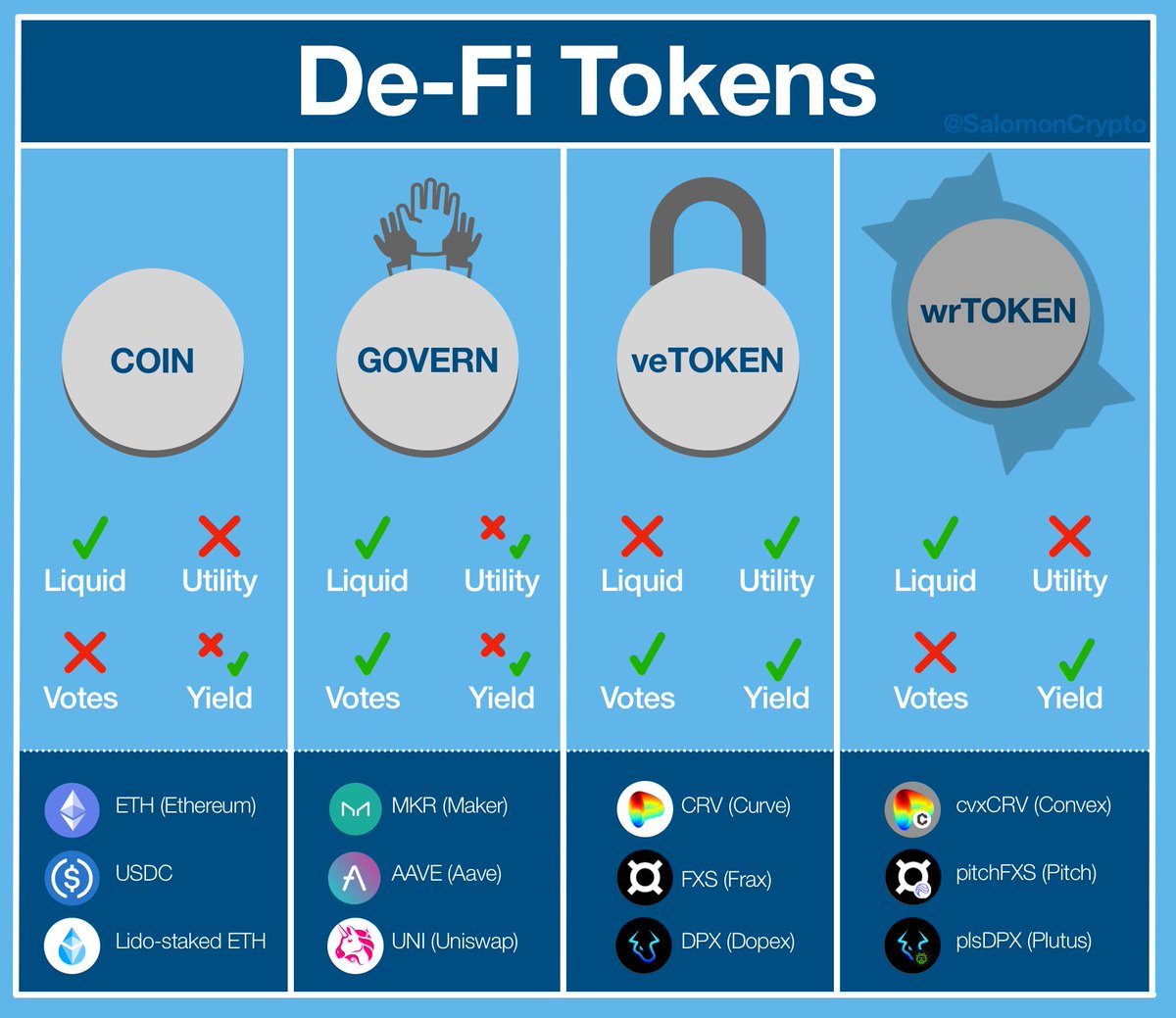

¶ Ve-Token System

The ve-token system is the first example of a technology that was inconceivable before The World Computer.

Built upon the technologies provided by many different protocols, the system leverages these money Legos to build a system that no single builder could have made.

Core to understanding the ve-token revolution is understanding “bribing” (aka voting incentives).

This process is how De-Fi expresses the economic value of the voting power of a ve-token, and provides credibly neutral monetization channels.

Look at Trad-Fi; tokens are ROUGHLY analogous to stocks. Today, most stockholders ignore their voting power or delegate to a proxy.

Imagine a world where a stockholder could monetize that power.

The stock market is centuries old, De-Fi is 2... but De-Fi did it first.

¶ Stablecoins

Not sold? Let's talk about stablecoins.

First, we borrowed from the real world; stablecoins mirrored the value of real-world cash.

Today, stablecoins are evolving into a new principle: as a protocol's TVL rises, it has a should try to return liquidity back into De-Fi.

¶ Protocols

Sophisticated programmable money has permeated through much of De-Fi. Here are just a few examples:

- Dopex has created composable, programmable options. These options can be paired with an endless combination of products to create novel financial products (Atlantic Options)

- Olympus DAO has developed a robust theory and application of De-Fi bonds to shape monetary policy

- Synthetix has developed a new economic primitive that can be broken down and remade into a synthetic version of almost any asset.

These protocols and so many more are developing products that combine different money legos to create something brand new.

¶ De-Fi is a Better Way

Back in Corporate-Fi, I used to manage $10+B/year in cash flow.

Even at the highest levels, nothing works... almost everything is smoke and mirrors.

But I believe there is a better way.

First we need transparency and credible neutrality.

Then we need innovation.

This is just the beginning. De-Fi is so young, programmable money is practically an infant.

It's impossible for a single person to project out.

But that's the thing about Ethereum: no single person has to.

Every person can contribute.

Today and in the future.

Forever.

¶ Resources

Source Material - Twitter Link

Source Material - PDF