¶ Dopex Programmable Options

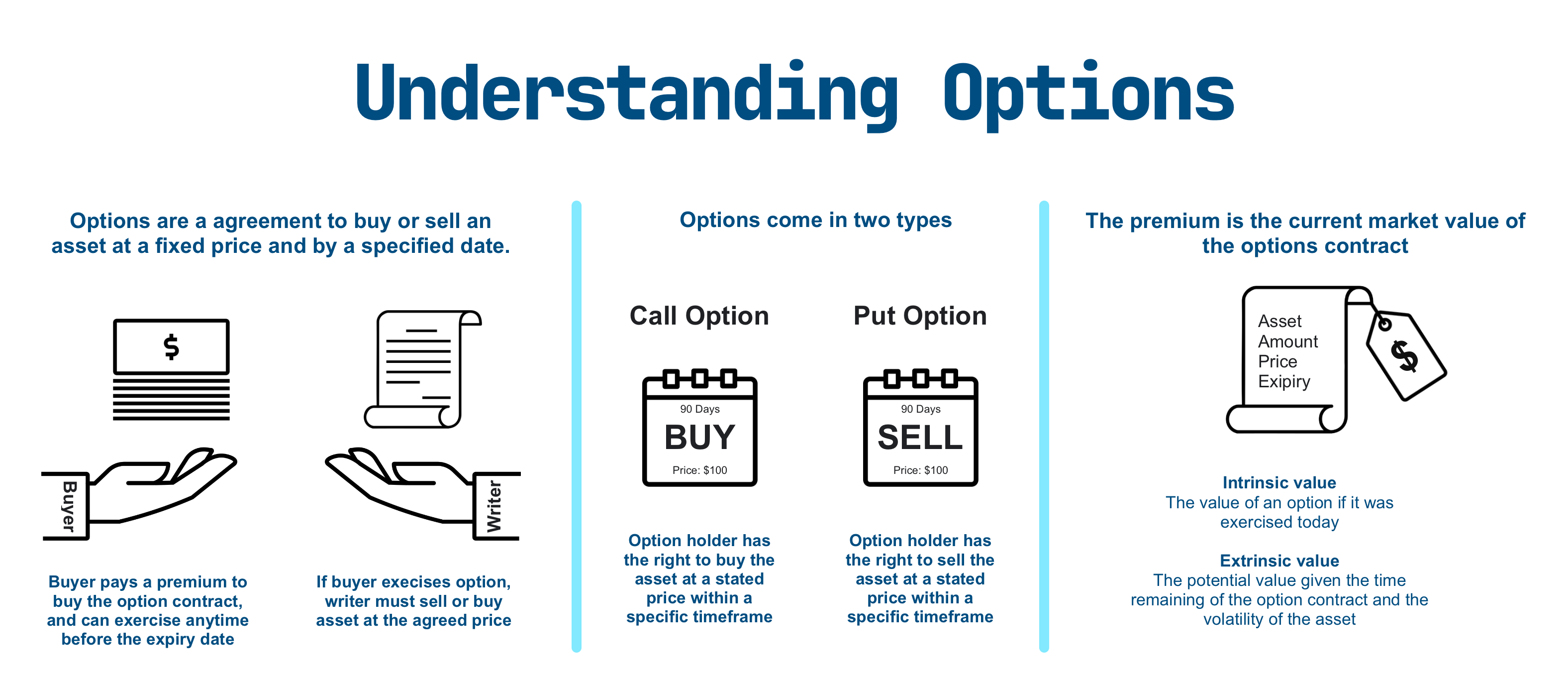

¶ Options 101

Options are a contract between two parties to buy/sell an asset (in the future) using a fixed price and date.

At that future date, the option buyer has the choice whether to continue with the buy/sale; the seller does not.

Options are (usually) either Call or Put options.

¶ Call Options

Call Option: the right, but not the obligation, to buy an asset in the future.

- Eg ETH costs $1500 and you can purchase a call option on ETH at $1750. If the price of ETH is higher than $1750, you can exercise the option and buy ETH below market price.

¶ Put Options

Put Option: the right, but not the obligation, to sell an asset in the future.

- Eg $ETH costs 1500 and you can purchase a put option on $ETH at $1250. If the price of ETH is lower than 1250, you can exercise the option and sell ETH above market price.

¶ Option Premium

The economic pin that this all revolves around is the premium. This is the fee paid by the buyer of the option to the seller of the option.

The buyer will always pay and the seller will always receive the premium, regardless how the option settles.

¶ Option Styles

Trad-Fi has two major styles of options: American and European.

Both styles are similar, the key difference is the window in which the buyer may exercise the option.

- American options: exercise AT ANY TIME before expiry.

- European options: exercise ONLY AT expiry.

But this is De-Fi; we aren't constrained by the old ways of thinking.

We have programmable money!

¶ Dopex Option Styles

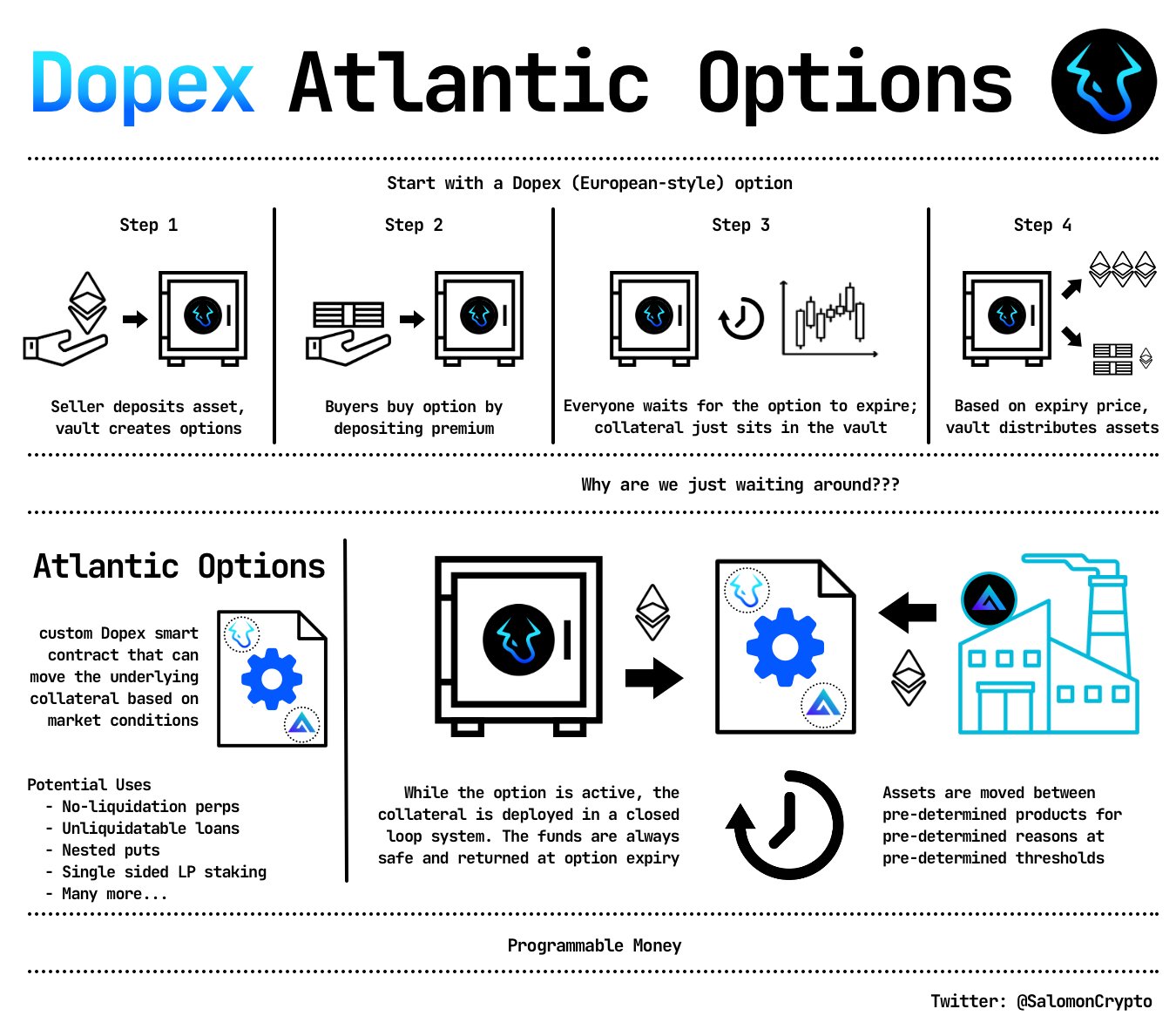

At first glance, a Dopex option seems very similar to a European option; both can only be exercised at expiry.

Under the hood, Dopex adds state of the art De-Fi paradigms and technology to build a much more compelling product.

Out of the box, Dopex options gain many of the benefits of De-Fi:

- Composability - options are an ERC-20 token that can be used in other protocols, leveraged, OTC, etc

- Incentivized - DPX emissions and veDPX bribes boost investment profile

- Transparent - all on-chain

The real innovation, however, is with the collateral.

In an Trad-Fi option, the collateral used to write the options is held in trust at a centralized location.

In a Dopex option, the collateral can be used for... almost anything!

¶ Programmable Collateral

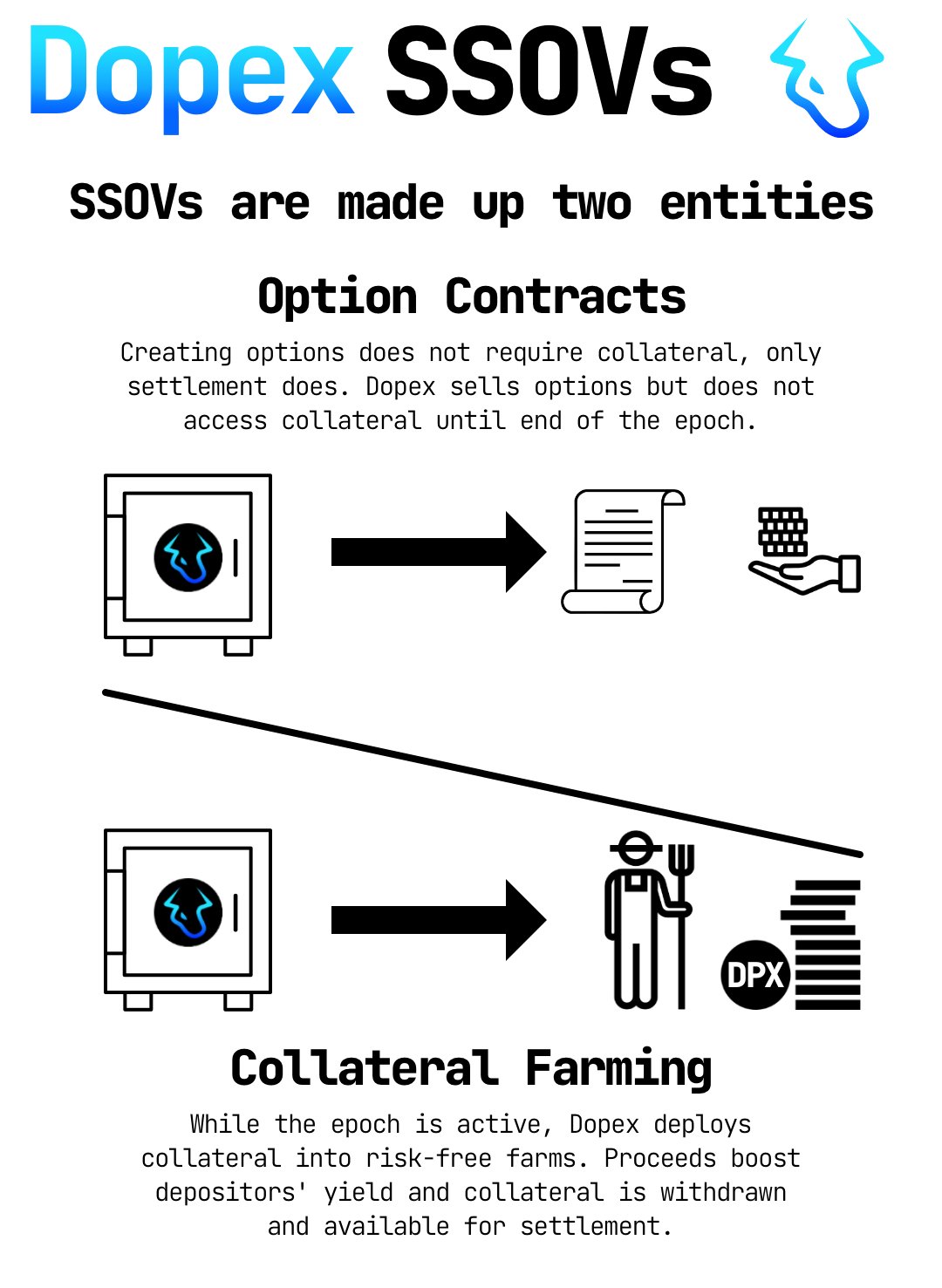

Dopex's 's first and best known product are Single Staking Option Vault (SSOV).

They should be understood as the combination of two products:

- An option contract with European-style settlement terms.

- A single sided yield farm

The option only requires access to the collateral at settlement and, because it has European-style settlement terms, Dopex knows exactly when that moment is going to be.

Until then, Dopex can deploy the collateral into risk-free farms to boost yield.

It is critically important that Dopex deposits the collateral into risk-free yield farms; the collateral WILL be needed in a relatively short amount of time.

Single asset staking the perfect candidate for SSOVs: boosted yield without an IL risk.

This presents a compelling opportunity for other protocols; Dopex can build a SSOV around a whitelisted single asset farms.

Now, instead of simply diluting token holders, these emissions will directly incentivize options liquidity.

At this point you might be asking yourself "if Dopex can deposit collateral into a single asset farm... can Dopex use the collateral anywhere else?"

The answer: of course, the options are as wide as the Atlantic!

¶ Atlantic Options

Dopex Atlantic Options are smart contracts that pair a Dopex-style option with another (white labeled, custom integrated) De-Fi product.

Each Atlantic product has to be careful constructed to ensure that at settlement the collateral is 100% guaranteed to be there.

But once that's taken care of, the results are MAGIC:

- One-click straddles

- No-liquidation perps

- Unliquidatable loans

and so much more!

As of today, Dopex has one Atlantic option product: Atlantic Straddles.

Straddles are a common option strategy which bets on an asset's price moving quickly (either up or down); Dopex has simplified this into a one-click process.

The results: jaw-dropping.

¶ A Revolution

To those with a passing interest in finance and crypto, Dopex might just seem like another meme DAO with a (sometimes) hot token.

Those of us deep in the rabbit hole see something else.

We see a revolution.

¶ Resources

Source Material - Twitter Link

Source Material - PDF