¶ Options

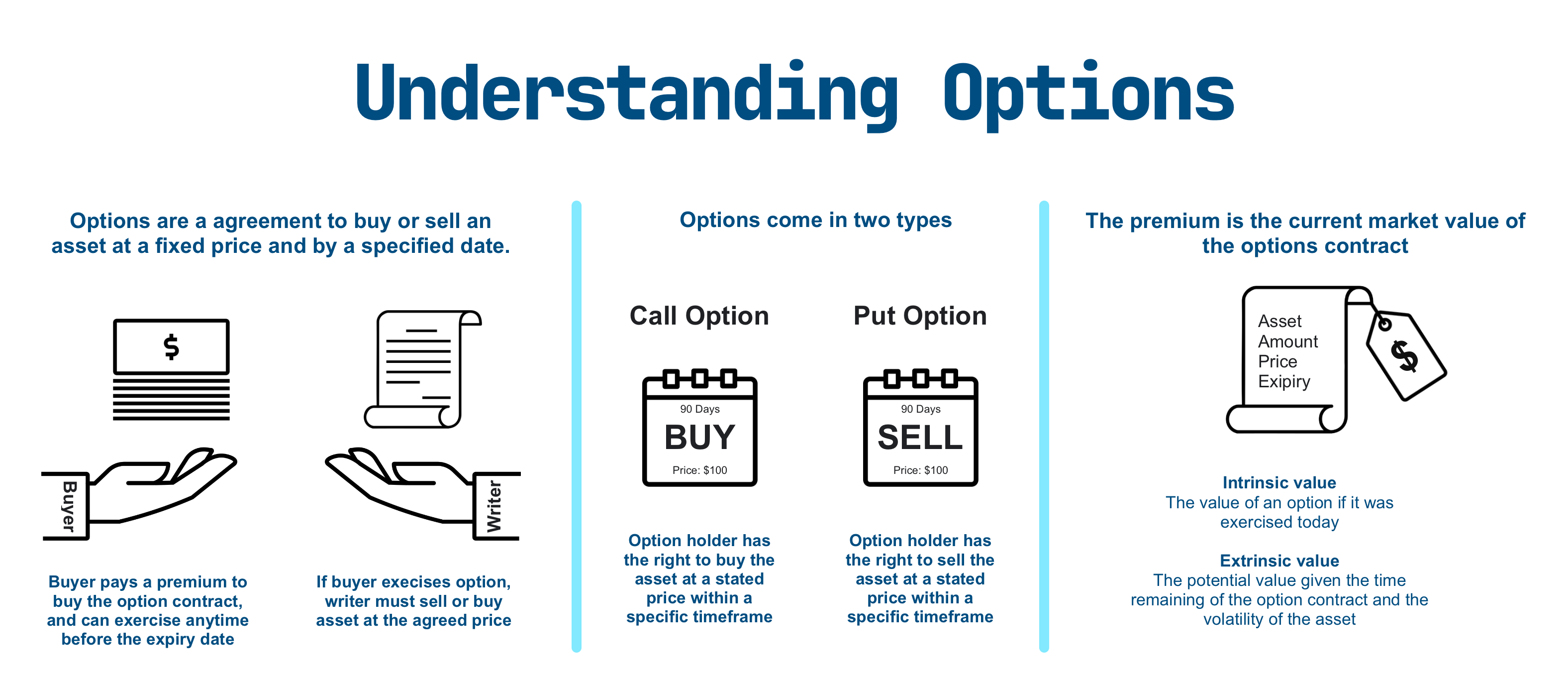

Options are a contract between two parties to buy/sell an asset (in the future) using a fixed price and date. At that future date, the option buyer has the choice whether to continue with the buy/sale; the seller does not.

Options are (usually) either Call or Put options.

¶ Call Options

Call Option: the right, but not the obligation, to buy an asset in the future.

- Eg ETH costs $1500 and you can purchase a call option on ETH at $1750. If the price of ETH is higher than $1750, you can exercise the option and buy ETH below market price.

¶ Put Options

Put Option: the right, but not the obligation, to sell an asset in the future.

- Eg $ETH costs 1500 and you can purchase a put option on $ETH at $1250. If the price of ETH is lower than 1250, you can exercise the option and sell ETH above market price.

¶ Premium

The economic pin that this all revolves around is the premium. This is the fee paid by the buyer of the option to the seller of the option.

The buyer will always pay and the seller will always receive the premium, regardless how the option settles.

¶ Option Styles

Trad-Fi has two major styles of options: American and European.

Both styles are similar, the key difference is the window in which the buyer may exercise the option.

- American options: exercise AT ANY TIME before expiry.

- European options: exercise ONLY AT expiry.