¶ The Global Financial Crisis

¶ Background

At the turn of the 21st century, American-brand capitalism was at its peak. The USSR had fallen, inflation was domesticated and technology was promising increasingly accelerated returns.

The global economy, priced in USD, flowed through the American financial system.

The REAL seeds of the Global Financial Crisis were sown centuries ago, but we'll locate the beginning point in the 1970s & 1980s. The American economy, always centered on one's home as the primary tool for wealth building, had been liberated by a series of laws and (de)regulations.

This was fueled by innovations in financial tools that allowed for increasing amounts of leverage.

¶ Financial Innovation

A Mortgage-Backed Security (MBS) is a financial product based on a mortgage (or a collection of mortgages).

Let's say Alice has a Mortgage with BankCo, meaning Alice has a loan with BankCo. BankCo can sell this loan by creating a MBS. Alice's future mortgage payments will go to the new owner of the MBS.

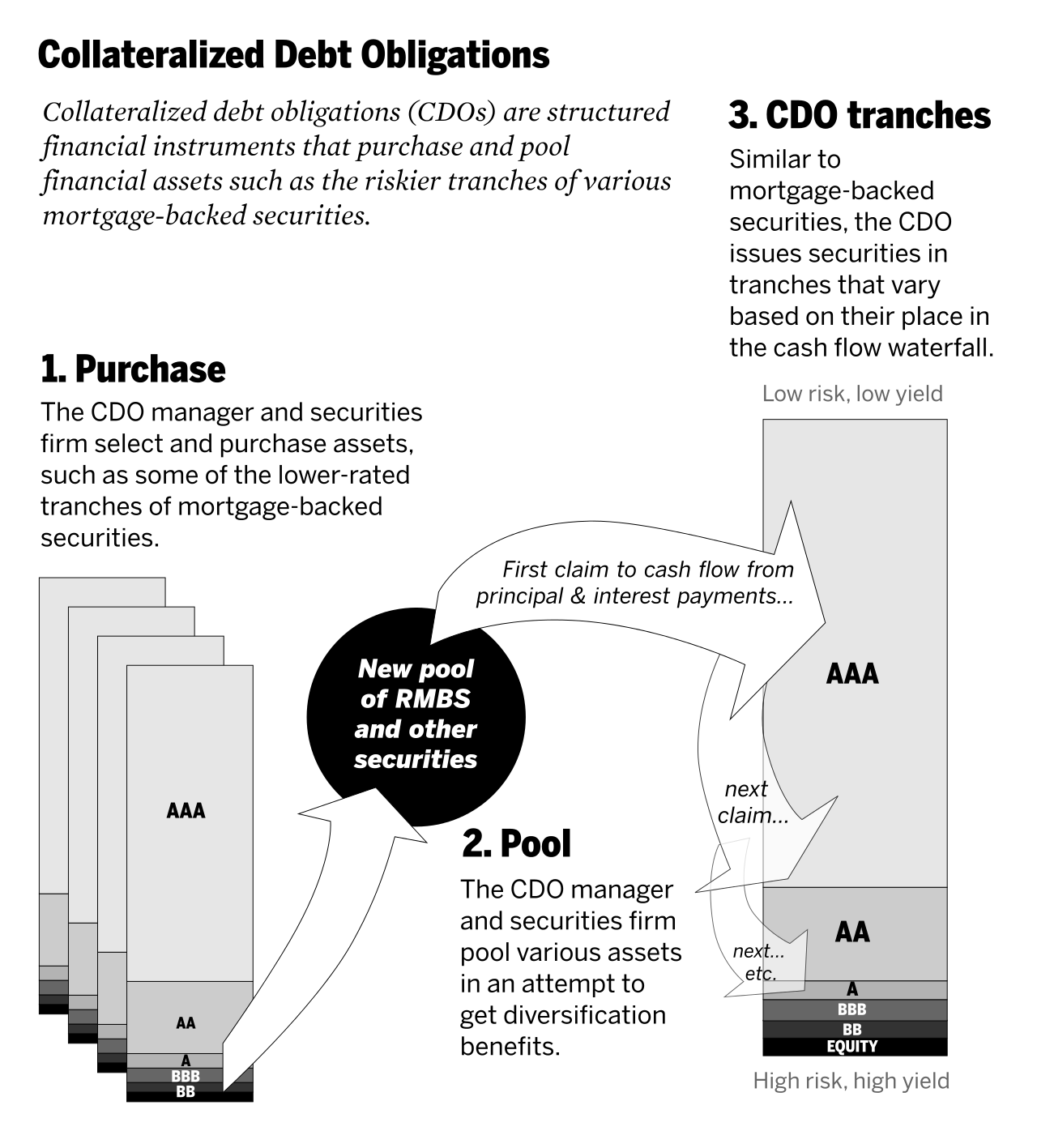

A Collateralized Debt Obligation (CDO) is similar to an MBS, but adds many more features. First and foremost, CDOs always contain a wide pool of mortgages, with each with an unrelated homeowner that is paying mortgage payments every month. An CDO is less risky than an individual mortgage, as its less likely that many homeowners will default instead of just one. The other important distinction is that CDOs offer tranching.

For our purposes, we can think of/use MBS and CDO interchangeably. Just think “financial product backed by a large basket of mortgage loans.”

In good times, MBS increased liquidity and attracted huge amounts of capital into the housing market. Investors threw money at banks to get them into the hottest MBS.

Banks, never ones to turn down money, did everything they could to deploy this capital...

…everything.

¶ The Mortgage Flywheel

Banks and other lenders would extend credit to anyone with a pulse.

0% down, no credit checks just sign on the dotted line.

Just get the money out there.

What do they banks care? Normally, you'd only want to lend to borrowers you think can pay back the loan, but MBS distort the incentives. The people making loans are not the same people that hold the risk. In fact, the banks get paid when they issue the mortgage and then again when they sell the MBS.

All without carrying the mortgage risk.

"ThE iMpoRTaNt THiNg iS pRInCPIaL GrOWth," they said. "Buy a house, capture some equity, hold it over time, build wealth." These insane lending conditions encouraged tons of people to buy property, increasing buy pressure.

You De-Fi folks seeing it yet? It's a flywheel!

The US Home Real Estate Flywheel:

- Investors buy MBS, giving cash to banks

- Banks deploy capital to earn yield (mortgages), improving borrowing conditions

- People buy homes, increasing home price

- Increased home price creates investable equity

- Investors buy MBS

Americans received cheaper and more accessible capital, investors received "safe," high-dividend investments and banks got to scalp a fee at every layer of the complex system.

Win-win-win!

Well... at least that's what everyone had convinced themselves.

¶ Growing Risks

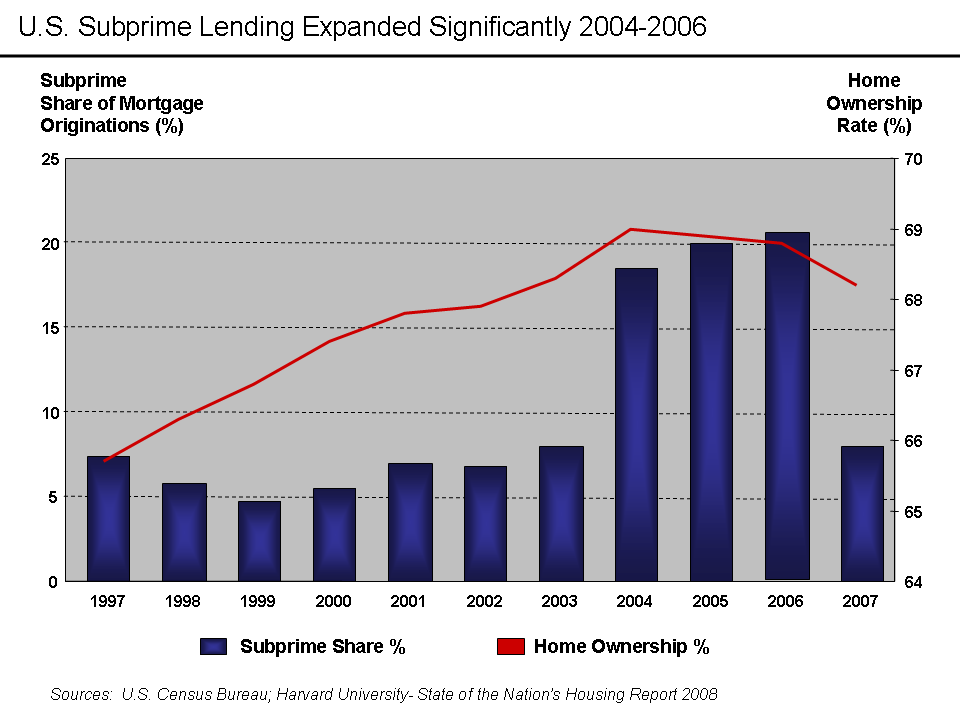

Over the previous few decades, the American mortgage-backed securities and their derivatives market grew to dominate the global economy. The explosive growth fueled by the endless supply of increasingly foul subprime mortgages.

The mortgage crisis was about to become something far larger. By the mid 2000s, there are so many bad loans out there!

Some shouldn't have been made at all, they were completely unaffordable. Others were downright predatory: maybe you got a 30-year 3% APR loan, only to realize that after 3 months it goes to 30% APR.

In 2005, CDOs were seen as the safest, most conservative security on the planet. Millions of mortgages, dynamically packaged to make them like gold.

AAA.

Bear Stearns promised! Merrill Lynch promised! Moody's PROMISED! S&P PROMISED! Fitch PROMISED!

It was these promises that brought everyone in, that grew they bubble so large. Pensions, mutual funds, hedge funds, corporations, states, cities, countries, continent-wide economic EUnions... everyone.

Though, to be fair, it wasn't just their promises. There was A LOT of greed.

Fall 2008:

- CDOs: ~$7 trillion

- Synthetic CDOs: ~$5 trillion

- Insurance/speculation (Credit Default Swap) market? ~$40 trillion

For reference, the total American credit market was ~$25 trillion.

We've all learned it one time or another... flywheels are reflexive; hyper-fast growth means a hyper-fast crash.

¶ A Changing Tide

By late 2006, the system is beginning to crumble under its own weight. Promotional APRs are expiring and mortgage payments are ballooning. Home price growth has not only slowed down, it's beginning to decline.

Dramatically.

By summer 2007, the tides had shifted:

- Mortgage lenders New Century and American Home Mortgage filed for bankruptcy

- Bear Stearns liquidated 2 hedge funds with over $20B of exposure to mortgage-backed securities

- NetBank suffered from a failure due to similar portfolios.

As 2007 turned to 2008, the subprime mortgage crisis was in full swing; stocks experienced their worst January since 2000.

And yet, January would turn out to be 2008's high point; this year the subprime mortgage situation would morph from a crisis to a global cataclysm.

¶ Containing the Crisis

The first colossus fell on March 17; after teetering since the end of 2007, Bear Stearns faced bankruptcy.

Instead, in its first emergency meeting in 30 years, the Fed agreed to guarantee its bad loans to facilitate its acquisition by JPMorgan Chase (for a 95% discount).

The next day the Fed cut the federal funds rate for the 6th time in 6 months. It also authorized Fannie Mae and Freddie Mac to buy $200B in subprime mortgages, absorbing the toxic assets.

Everyone hoped that these actions (and Bear Stearns' rescue) would contain the crisis.

By late June, it was clear it the crisis was still growing; the stock market fell to 20% off all-time highs.

On July 30th, The United States Housing and Economic Recovery Act (HERA) was passed, authorizing the government to guarantee another $300B of new subprime mortgages.

¶ Collapse

In September 2008, the American Financial system stood face to face with obliteration. Its troops (underwriters) had been swept away. Its generals (banks) had been decimated. Stripped bare, it braced against the onslaught.

At the tip of the spear: Ben Bernanke and the US Federal Reserve. The vanguard behind: Henry Paulson and the (mostly disciplined) US Federal government. The muscle: the full faith and credit of the American people.

In the face of collapse, they began bailing out.

¶ September 2008

¶ Sunday, September 7th

Deep Dive: Fannie Mae and Freddie Mac

In the end, it turns out that even the $300B HERA was a twig trying to dam the Nile; on September 7th, it was washed away when the government took over Fannie Mae and Freddie Mac.

These two corporations were responsible for ensuring 56% of all US mortgages; their failure would expose $5T of mortgages

Fannie Mae and Freddie Mac were nationalized on a Monday; the following week the situation spiraled much further out of control.

¶ Sunday, September 14th

By the weekend, 2 of top 5 largest investment banks were on life support. Lehman Brothers and Merrill Lynch were counting their remaining time in hours.

On Sunday, September 14th, the US government decided who would survive and who would be sacrificed to the crisis.

After the Fed declined to facilitate its loans (like with Bear Stearns), Lehman Brothers filed for the largest bankruptcy in history.

The same day Lehman fell, Merrill Lynch was saved. During the morning a rescue-acquisition was announced by Bank of America; by evening it was finalized.

Turns out, the deal was one made under duress. Had BofA not stepped in, the US government directly threatened management's jobs.

¶ Tuesday, September 16th

On Monday, September 15th, Lehman failed, Merrill was snatched from disaster for pennies on the dollar and the Dow Jones dropped ~4.5% (its largest decline in 7 years). But the government barely noticed; it was frantically at work on the biggest bailout yet.

AIG, the insurance giant who sat at the middle of this mess, was failing.

The problem: AIG insured over $500B of loans; ~$60B of which were subprime mortgages.

On Tuesday, September 16th, the Fed took over AIG with $85B in emergency funding, eventually totaling $182B.

¶ Wednesday, September 17th

On September 17th, investors withdrew $144B from money market funds (compared to $7.1B the week before). The government immediately extended depositor insurance.

Even as the government ran around trying to keep the balls in the air, there was only so much they could do.

¶ Thursday, September 18th

On September 18th, In a dramatic meeting US Treasury Secretary Paulson and Fed Chair Bernanke met with House Speaker Pelosi; Bernanke requested a $700B bailout fund.

"If we don't do this, we may not have an economy on Monday."

¶ Monday, September 29th

On Monday, September 29th Bernake's requested bill was voted on in the House of Representatives and lost (mostly party line vote, Democrats for, Republicans - against). But, in the end, everyone got in line.

This is the peak of the Global Financial Crisis. First the decades of bubble-building, then the last year of fighting off disaster, all building up to this moment.

When it came time for Wall Street to confront the monster it created, Wall Street crumbled with a whimper.

¶ Metastasization

¶ American Auto Industry

At this point, the destruction of Global Financial Crisis is growing outside of the financial system.

In September 2008, America's Big Three car companies (Ford, GM and Chrysler) began asking for bailouts; a $25B loan was followed by a $17.4B bailout before year's end.

Alas, the measures were not enough, GM and Chrysler would go bankrupt by the end of 2009.

Closing the Big Three directly would result in the destruction of 3MM jobs, the loss of $50B/year in tax revenue and (at least) -.2% GDP growth.

And so, the government saved them.

¶ International Contagion

As the Americans attempted to plug the holes in the sinking titanic financial system, the crisis bloomed into a full blown global catastrophe.

On October 8th, The Indonesian stock market halted trading after a one-day 10% drop.

On October 11, the International Monetary Fund (IMF) warned that the world financial system was teetering on the "brink of systemic meltdown."

On October 14th, after 3 successive days of suspension, the Icelandic stock market opened 77% lower than it had been on the 8th. Iceland continued to teeter on the brink of disaster for all of October/November. By year's end, it would experience the largest banking collapse (relative to its size) in history. In January 2009, all 3 major banks had failed and been nationalized, Icelanders were in the streets and the government collapsed.

On December 6th, the first Greek riots began, marking the early days of the European Debt crisis.

¶ Stabilization

On October 1st, Emergency Economic Stabilization Act was passed.

The main pillar of The Emergency Economic Stabilization Act was the Troubled Asset Relief Program (TARP), a $700B fund used to purchase toxic assets from banks. The Treasury would go on to deploy hundreds of billions of dollars to provide liquidity for garbage investments.

By the end of 2008, Congress had created two MASSIVE new programs:

- Troubled Asset Relief Program (TARP) - $700B to remove toxic assets from the financial system

- Term Asset-Backed Securities Loan Facility (TALF) - $200B to provide capital/liquidity for consumer lending

In February 2009, Congress approved the American Recovery and Reinvestment Act (ARRA), a $831B economic stimulus package. ARRA's rationale: during recessions, the government should offset the decrease in private spending with an increase in public spending. The politics around the stimulus were extremely contentious, split across party lines.

On the left, the Democrats and the new President, Barack Obama.

On the right, the Republicans and the new movement, the Tea Party.

¶ The Great Recession

Up until this point, every American had experienced the crises of 2007/2008 together. The chaos struck everyone with equal surprise and force. Regardless if you were a Wall Street bank or a humble family buying a new home, everyone tumbled.

Together.

I think we can trace this dynamic up until March 6th, 2009. The Dow Jones hit its lowest level, a drop of 54% from its high 17 months before.

Beginning March 10th, the Dow Jones began recovering.

And so, at least for some Americans, the crisis passed.

On April 10th, Time magazine declared "More Quickly Than It Began, The Banking Crisis Is Over."

In June, The National Bureau of Economic Research (NBER) declared June 2009 as the end date of the U.S. recession.

¶ Dodd-Frank

Over the next year, as the dust began to settle over the destruction, the economy began slowly recovering.

This was further bolstered in July 2010, when the Dodd–Frank Wall Street Reform and Consumer Protection Act was enacted. Dodd-Frank overhauled regulation in the aftermath of the Global Financial Crisis, affecting almost every part of the financial system.

There is still debate on the effect of Dodd-Frank, but the truth is that it restored the confidence needed to restart the economy.

Even if this new economy's growth was anemic.

¶ The Aftermath

The Global Financial Crisis was so much bigger and more destructive than can be realistically communicated. Here are just a few of the important results that flowed from the crash.

¶ Monetary Policy

In November, in an attempt accelerate the disappointing economic recovery, the Fed announced another round of quantitive easing.

And so, just like the next decade of politics was defined in reaction to the Crisis, so was monetary policy.

¶ American Experience

It's 2010, and this chapter is closing. The American government, media and financial system are all proudly congratulating themselves on vanquishing the financial crisis. They've even flipped on the money printer in celebration. But how's everyone else doing?

According to the National Bureau of Economic Research, the Great Recession was officially in June 2009.

And yet... almost no one agreed.

In early 2010, mortgage delinquency rates in the US peaked at 12%.

In 2011, median wealth had fallen 35% from 2005 highs.

In 2012, many homeowners still faced foreclosure and couldn't refinance their mortgages.

A 2018 Fed study estimated it cost every American ~$70,000 in lifetime earnings.

This was the moment many learned just how different the world was than the one suggested by official statistics. Your experience of the next decade was dependent on your net worth. Based on how much discretionary capital you had access to, it was either the most incredible boom known to mankind...

...or a daily struggle to keep a roof over your head and food in your family's mouth.

For nearly 10 years, the rich and the poor diverged further and further... in fact it still is! Eventually, a few people realized an opportunity. The economic inequality had created latent tension in the US population; tension that had built to alarmingly high levels.

In the United States, the Republican party, fueled by the chaos of the collapse and the energy of the Tea Party movement, would go on to sweep the 2010 midterms. They would then go on to use this control to reshape American politics.

This is the genesis of the polarized disaster we see in Washington today

¶ European Debt Crisis

¶ Context

In Europe, the Global Financial Crisis immediately rolled into a more more difficult problem: the European Debt Crisis. Stemming from the unique structure of the European Union and the Eurozone, the European Debt Crisis threatened the very concept of the European project.

In 1999, the euro was adopted. The economic union would bind the nations of Europe together, for better or worse.

Debt accumulation across the eurozone was very unequal and reflected many of the macroeconomic difference between the countries. In general, northern European economies were more developed (slower growth, less inflation, more savings/investment) than southern economies.

Despite these differences, the European Central Bank had to pick ONE interest rate for the euro. And so, it favored the north.

The result: southern European countries accumulated debt much faster than the north, particularly by the private sector. Eurozone member states could have alleviated the imbalances in by coordinating national fiscal policies...

…but they didn't.

¶ Crumbling Facade

Many countries, led by France and Germany, were using arcane accounting rules to mask their debt levels.

In 2009, after months of intense riots, a newly elected Greek government gave up these practices and restated their 2009 deficit forecast from 7% of GDP to 13%.

From Greece, the European Debt Crisis exploded outward. Greece, Portugal, Ireland, Spain and Cyprus all defaulted in one way or another. All 5 had to be bailed out from 2010-2012. Greece twice.

10 of 19 countries saw major government shifts as a result of the crisis.

¶ Zero-Sum Games

When any debt asset declines in value, someone has to take the associated loss; it becomes a zero-sum game between lender and borrower.

Germany, the creditor, took a hard line against the Greeks and all other distressed nations. "The Greeks took the debt, they should take the loss. It's only fair..."

...says the creditor.

The crisis brought the fundamental question of the eurozone into question. The economic union, originally viewed as a celebration of capitalism and cooperation was seen in a new light:

The capture of Europe's financial system by the North, weaponized against the South.

Throughout the 2010s, the European Debt Crisis was managed back to stability, but not without extracting a major toll. The south saw economic ruin, the north felt responsible for bailing out its irresponsible neighbors, and ALL Europeans entered an era of austerity.

¶ Ending the Union

Many people discussed breaking up the union (or at least leaving it).

The Greeks wanted out ASAP to regain control of their central bank, but by 2011 even Bloomberg was suggesting that Germany should consider skipping out because Greece and Ireland looked so toxic.

And then one country actually did it.

¶ Brexit

Convinced by an incredibly well financed campaign of lies, on June 23, 2016 the citizens of the United Kingdom voted to Brexit and leave the European Union.

For the UK the result was a disaster: October 2021, the UK government calculated that Brexit would cost 4% of GDP/year over the long term.

For Europe, the result was worse: The EU, an institution created to stop the European War Machine, has begun falling apart.

¶ Turning East

Globally, the world's faith in Western finance was shaken, threatening America's global hegemony. The destruction on the West spread across the Pacific, but Asia's financial sector weathered the storm much more gracefully.

China, quickly industrializing and massively centralized, was the foundation of the economic resilience of Asia.

After 2008, the world (especially the global south) turned to China and away from the West, reshaping the global balance of power.

¶ Consequences and Legacy

And so, we will close our story of the Global Financial Crisis in 2016:

In Europe, the postwar project to end World War forever has taken a mortal blow.

In America, Donald Trump was elected as the 45th President.

The fruits of 500 years of Western world domination.

¶ The Limits of Consolidation

When trying to understand the Global Financial Crisis, you should approach it from a few different angles. First, you should understand 2008 as the logical conclusion to the Western financial system.

500 years ago, Europe was a backwater on the far tip of the Eurasian continent. Born out of the battlefields of the Reconquista and the Elector Halls of the German princes modern finance would give the Europeans (and later Americans) the power to conquer the world.

The secret: the concentration of private wealth and coordination with the nation-state.

And at its zenith, it failed.

But “thankfully,” in the end it was so centralized that a handful of men could step in and save the whole thing.

I just wish someone would have stopped to ask if the whole thing should have been saved.

¶ The Reality of Fairness

But there's another lesson in the Great Financial Crisis.

Fundamentally, the American (and world) economy was crippled by the actions of the leaders of the American financial sector. The Great Recession wiped out 8 million jobs more than 4 million homes faced foreclosure. The US government, on behalf of the American people, stepped in to avoid annihilation…

…or at least the annihilation of the lenders. Never mind the fact that the lenders were the people who created this whole mess in the first place.

The U.S. government did not restrict capital flows to executive pay, dividends, or anything like that. Instead, it chose to “punish” those leaders by giving them enormous sums of money through bailouts.

In contrast GM and Chrysler were forced to fire their CEOs and cut unionized workforces pay. I'm not even sure the American tax payer was considered.

Justice is fairness. In a fair world, good behavior is rewarded, bad acts are punished.

The bailouts may have been effective or staved off a bigger disaster (if you believe the people responsible), but the bailouts were not fair.

And things only got worse since.

Even if we accept the argument that focusing almost entirely on the health of the financial sector was the best way to handle the crisis, the actions corroded the bonds of trust required for the functioning of democracy.

The Global Financial Crisis was an economic fire that burned hotter than humanity had ever seen; the world was remade in its crucible.

Fire is chaos.

Fire is destruction.

Fire is ruin.

But fire is also cleansing. It can open a path for something new.

¶ Resources

This article combines the work of 5 tweet threads:

- The Global Finance Crisis

- Source Material - Twitter Link

- Source Material - PDF

- The Global Finance Crisis - Part I

- Source Material - Twitter Link

- Source Material - PDF

- The Global Finance Crisis - Part II

- Source Material - Twitter Link

- Source Material - PDF

- The Global Finance Crisis - Part III

- Source Material - Twitter Link

- Source Material - PDF

- The Global Finance Crisis - Part IV

- Source Material - Twitter Link

- Source Material - PDF