¶ Reserve Currency

¶ Definition

A reserve currency is one that:

- Has the depth and liquidity to allow for reliable and efficient international transactions

- Can be freely and easily exchanged for other currencies

- Is held by many monetary authorities and institutions, in significant amounts

Central banks and major financial institutions regularly do 8+ figure transactions across international borders, requiring huge amounts of liquidity. Reserve currencies are held in large sums used to settle these transactions.

Reserve currencies help facilitate global trade and provide a stable store of value

¶ Store of Value

A store of value is an asset that can be saved, retrieved, and exchanged in the future without deteriorating in value.

Argentina, Turkey and many other countries regularly face annual inflation above 50%. Citizens will often save by holding reserve currency notes (USD). Holding a reserve currency minimizes exchange rate risk, as the purchasing nation/institution will not have to exchange its currency for the current reserve currency to make the purchase. A large percentage of commodities are priced in the reserve currency.

¶ Global Reserve Currencies

¶ A Brief History

The world's reserve currencies (since the late middle ages):

- Venetian ducat/Forentine florin

- Spanish silver dollar

- Dutch guilder

- British pound sterling

- American dollar

The British pound achieved reserve status on the heels of the United Kingdom's global empire - the largest in history. Over the 20th century, the British had remade their empire to be focus around central banking and the pound's reserve status.

After World War II, a broken British empire surrendered the financial network to the US; included was global reserve currency primacy.

¶ Current Status

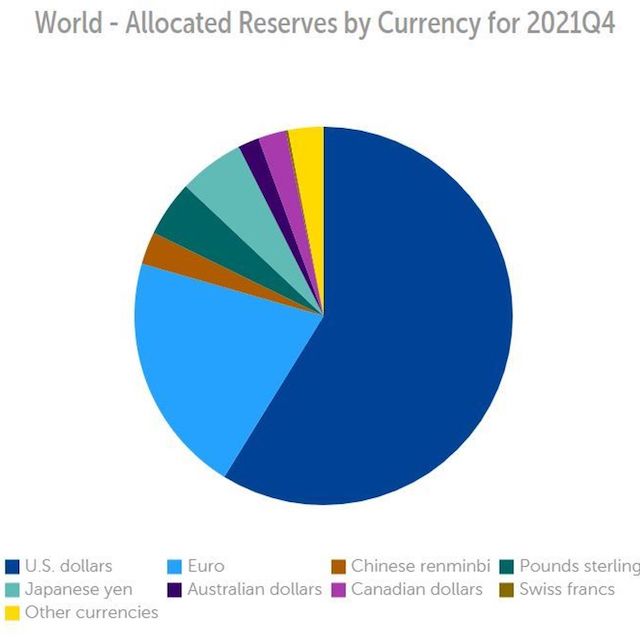

Today, ~60% of the world's reserves are held in US dollars. The Euro is second at 20%. Then Yen (5%) and RMB (5%).

The world's need for dollars has allowed the US government to borrow at lower costs, giving the United States an advantage in excess of $100B per year.

The top reserve currency is generally selected by the banking community for the strength and stability of the economy in which it is used.

As a currency becomes less stable, or its economy becomes less dominant, over time banks may abandon it for another currency.

¶ Control the Reserve Currency

And, self-fulfillingly, having control over a reserve currency is what allows capitalists to create dominant and stable economies

For example, the US would not be able to save itself from the Global Financial Crisis in 2008 without control of the world's reserve currency.

Control over the world's reserve currency was required to save the world from the Global Financial Crisis...

...and yet, the question must be asked: was the Global Financial Crisis even possible without control and exploitation of that system by American capitalists?

And there's one more power control over the world's reserve currency gives you, especially if you team up with #2. You can wield it as a weapon.

In 2010, the UN called for abandoning the U.S. dollar as the world's reserve currency. The report states that a new system should not be based on national currencies but foster international liquidity to create a more stable financial system.

The UN has its suggestions, I have my ideas.

Regardless, we both agree that we need to build a system with credible neutrality; a system that treats all participants equally, that does not discriminate or reward.

¶ Resources

- Source Material - Twitter Link

- Source Material - PDF