¶ The Federal Reserve System

¶ Background

Before we understand modern central banking, we need to understand how we got here. ~500 years ago, in the backwater of Europe, the world changed forever. On the battlefields of Iberia and the halls of the German Electors, modern finance was born.

Since then, the way humans and societies operate has developed along the principals laid back in the 16th century:

Consolidate power. Concentrate wealth. Coordinate with the state.

Fast forward about ~400 years and well... let's just say that Charles V would be impressed.

¶ The Federal Reserve

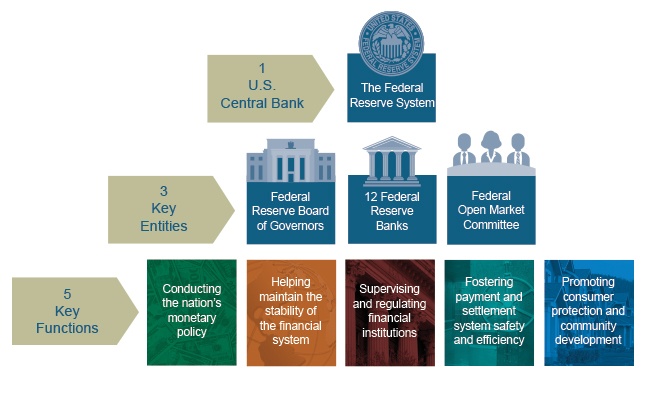

The Federal Reserve Act of 1913 established the Federal Reserve System (The Fed) as the country’s central bank. The Fed is designed as an independent, decentralized (their word) bank to better ensure that monetary policy would be based input from across the country.

The Federal Reserve System is made up of:

- Federal Reserve Board of Governors

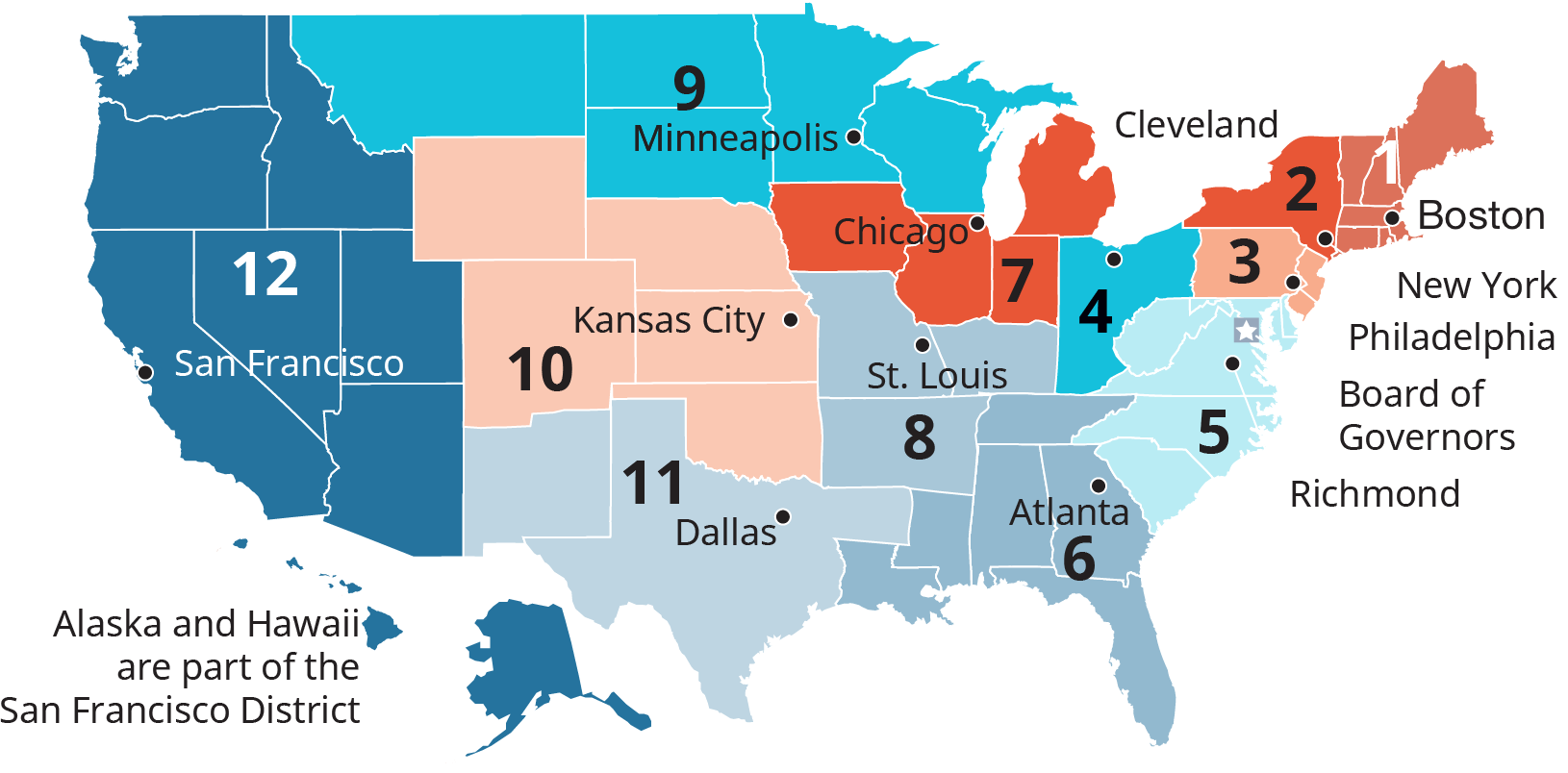

- 12 Reserve Banks

- Federal Open Market Committee (FOMC), composed of

- Federal Reserve Board of Governors

- President of NY Reserve Bank

- 4 other Reserve Bank presidents, rotating

The Fed Board and Reserve Banks are self-funded entities that deduct their expenses from their revenue and transfer the remaining amount to Treasury; revenues contribute to total U.S. Revenues, losses represent a cost to the U.S. taxpayer.

¶ Board of Governors

The Board of Governors is a federal agency, responsible for maintaining the stability of financial markets and the operations of the Reserve Banks.

There are 7 members who serve (staggered) 14-year terms. Governors are appointed by the President and confirmed by the Senate.

¶ Reserve Banks

Unlike the Federal Reserve Board, the Reserve Banks are not federal agencies; each Reserve Bank is a federally chartered corporation subject to the supervision of the Federal Reserve Board. Reserve Banks have stock, owned by commercial Member Banks (eg JPMorgan Chase or Wells Fargo).

Each Reserve Bank is structured like a private corporation, managing a P&L and paying dividends to stock holders. A Reserve Bank is overseen by a board of directors, made up of 9 members. 6 are elected by Member Banks, 3 are appointed by the Fed Board of Governors.

The Reserve Banks are the real world agents for the Fed, the U.S. Treasury and the U.S. Government. They are jointly responsible for implementing the monetary policy set forth by the FOMC.

¶ Federal Open Market Committee (FOMC)

Federal Open Market Committee (FOMC) is a committee of 12 members charged with overseeing the tools and actions of the Fed. The FOMC is the principal agent of US national monetary policy, influencing the total amount of money and credit available in the economy.

Typically, FOMC will issue directives to the Reserve Banks, who will enact these strategies and attempt to move the economy in the direction intended by monetary policy. The Federal Reserve Bank of New York (FRBNY) serves a special role and is responsible for most of the asset purchases and sales.

¶ Federal Reserve and Monetary Policy

Monetary policy, as per the Fed's definition, are the actions undertaken by a central bank to influence the availability of money and credit to help promote national economic goals.

There are 4 tools of monetary policy:

- Open Market Operations

- Discount Rate

- Reserve Requirements

- Forward Guidance

Using these tools, the Fed influences the supply and demand of liquidity in the system.

¶ Open Market Operations

Open market operations: the activities by the Fed to add or remove liquidity from the system. While there are many tools available, activities generally are:

- buy/selling government bonds

- repo agreements

- commercial bank secured lending

¶ Discount Rate

The discount rate is the interest rate charged to institutions who take out loans from a Reserve Bank. This lending facility, called the Discount Window, is meant to help manage short-term liquidity needs.

Higher borrowing rates = less loans = less liquidity in the system

¶ Reserve Requirements

The Reserve Requirements is the capital the Fed requires commercial banks to keep on hand (and not deployed/invested). If these requirements are high, banks must withhold cash from the system reducing overall liquidity.

¶ Forward Guidance

Forward guidance is the communication from the Fed about the state of the economy and the (likely) future course of monetary policy.

The goal: influence the financial decisions of the nation into more healthy behaviors and prevent surprises that might disrupt the market.

¶ The Dual Mandate

The Fed uses its 3 financial and 1 communication tools to achieve its goals as measured by The Dual Mandate:

- Price stability (inflation)

- Maximum employment

- Moderate long-term interest rates

(Yes, The Dual Mandate has 3 goals)

¶ The Big Questions

In summary, the Fed is the central bank of the USA. Using the financial and administrative tools bestowed by Congress, the Fed attempts to stabilize the economy, manage inflation and support a thriving employment market.

But if we want to really understand the Federal Reserve System of the United States of America, we have to put it in context...

The context of 500 years of centralization of power, consolidation of wealth & a system that encourages using public power for private ends.

Bottom line? We are entering an era of cascading crises & violent volatility. I am thankful we have the Fed with the power to resolve the 2008 Financial Crisis or the 2020 COVID Shock, but I'm growing increasingly concerned that this power exists in the first place.

Take a look at the political environment in the United States (for all you on the outside looking in, it's worse than it looks). For 500 years we've been centralizing power, culminating in the Fed.

Every day, one question becomes more and more urgent: Who is in charge?

¶ Resources

Source Material - Twitter Link

Source Material - PDF