OFAC Censorship

The World Computer

Ethereum is a distributed computing platform. A network of 1,000s of computers (nodes) coordinating using Proof of Stake (PoS) to keep the Ethereum Virtual Machine (EVM) in sync.

The EVM is the shared computing platform, the blockchain its history and ETH its lifeblood.

Ethereum is still very young. It is slow, expensive and still evolving.

But even though we are early, the Ethereum endgame has already come into focus:

ETH will be the pristine currency of trustless trust.

Trustless trust is predicated on a decentralized Ethereum. The more nodes that are controlled by a single entity, the easier it becomes to attack the network.

Trustless trust comes from credible neutrality.

Credible Neutrality

Deep Dive: Credible Neutrality

Credible neutrality comes from decentralization.

Every Ethereum user is willing to use the system because they know they will get the same treatment as any other user, whether that user is Vitalik Buterin or Uncle Andrey.

No government, company or foe can bend the rules to cause you trouble.

On the first order, the EVM provides credible neutrality simply by being a perfectly neutral system.

Just like the laws of physics are built into our world, unbreakable property rights are built into Ethereum.

Put simply, it's impossible to execute an unfair transaction.

Let's say a bank (XTF), run by a drugged up criminal (FBS) is in severe distress and needs a bailout.

IRL, FBS can just call the Federal Reserve and have them turn on the cash printers.

On-chain, there's no one to call. FBS has to take his Ls just like the rest of us.

This is not a new idea, this is the foundation of Ethereum, Bitcoin and cryptocurrency in general.

All users are treated equal. Anyone can interact with the blockchain for any time, for any reason.

...Enter the United States Government.

Tornado Cash Sanctions

In August 2022, the US Treasury hurled a Molotov Cocktail into the crypto community and declared that a piece of code (and all that wrote, used and support it) was a terrorist.

And, as all non-Westerners are very aware, America does everything she can to destroy "terrorists."

Two things.

As a result of the sanctions, Alex Pertsev was arrested and has been in custody since August 2022. Meanwhile, SBF ruined crypto and he's playing video games in his penthouse.

</ NOTE>

These sanctions are ridiculous for a ton of reasons, you can find a better explanation from back in August.

Let's just focus on the results: anyone who has ever touched (or been touched by) TornadoCash is now on the USA Office of Foreign Assets Control (OFAC) shitlist.

There are a ton of specifics around the OFAC shitlist, but the summary is that no one can do any financial transactions with anyone on that list.

Those that break this rule are also added to the list.

As the USA controls the global financial system, this is a HUGE deal.

Implications of Sanctioning a Protocol

Tornado Cash is not a small protocol. 1000s of people of use it for all sorts of reasons.

Yes, many reasons were/are shady, but many others were perfectly legit (and not all were consensual).

The first question on everyone's mind: were the users on the shitlist too?

Let's say Alice heard about Tornado Cash back in August 2021 and wanted to try out the tech with .1 ETH. She never used it again.

Now, in August 2022, Tornado Cash is a terrorist.

So does that make Alice a terrorist to?

These kinds of questions always have two answers: the "correct" answer, as it exists in the minds of US officials, and the market's answer.

The market doesn't reallllllyyyyy think things through, it just acts.

And so it decided that Alice is, in fact, a terrorist.

Remember, the way the OFAC shitlist works is that anyone who transacts with someone on the list also gets on the list.

So, when the market decides that Alice is a terrorist, it is also deciding that people who want to stay off the shitlist cannot transact with Alice.

Realities of Sanctioning a Protocol

So what does this mean for Ethereum, a platform that is predicated on equal access for all... even if a person shows up on the OFAC shitlist?

The EVM is a credibly neutral space, maintained by 1,000s nodes.

The EVM wont care about OFAC, but the node operators sure do.

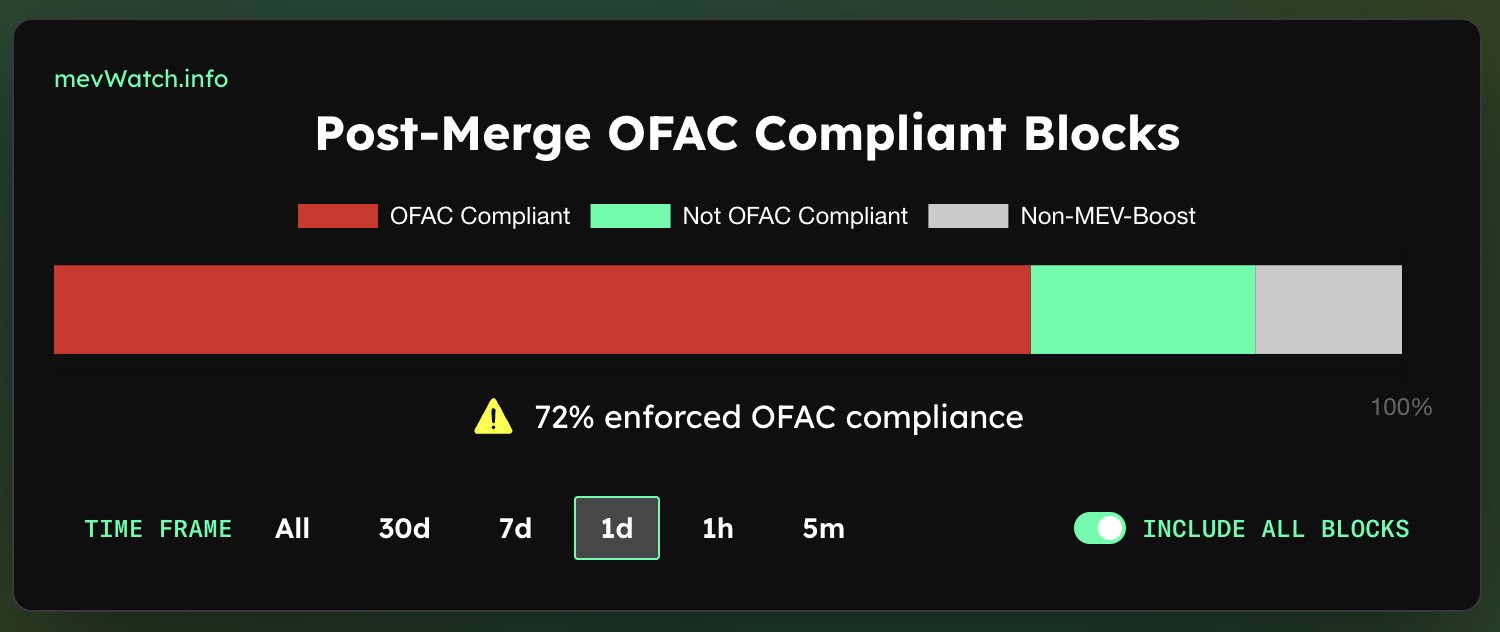

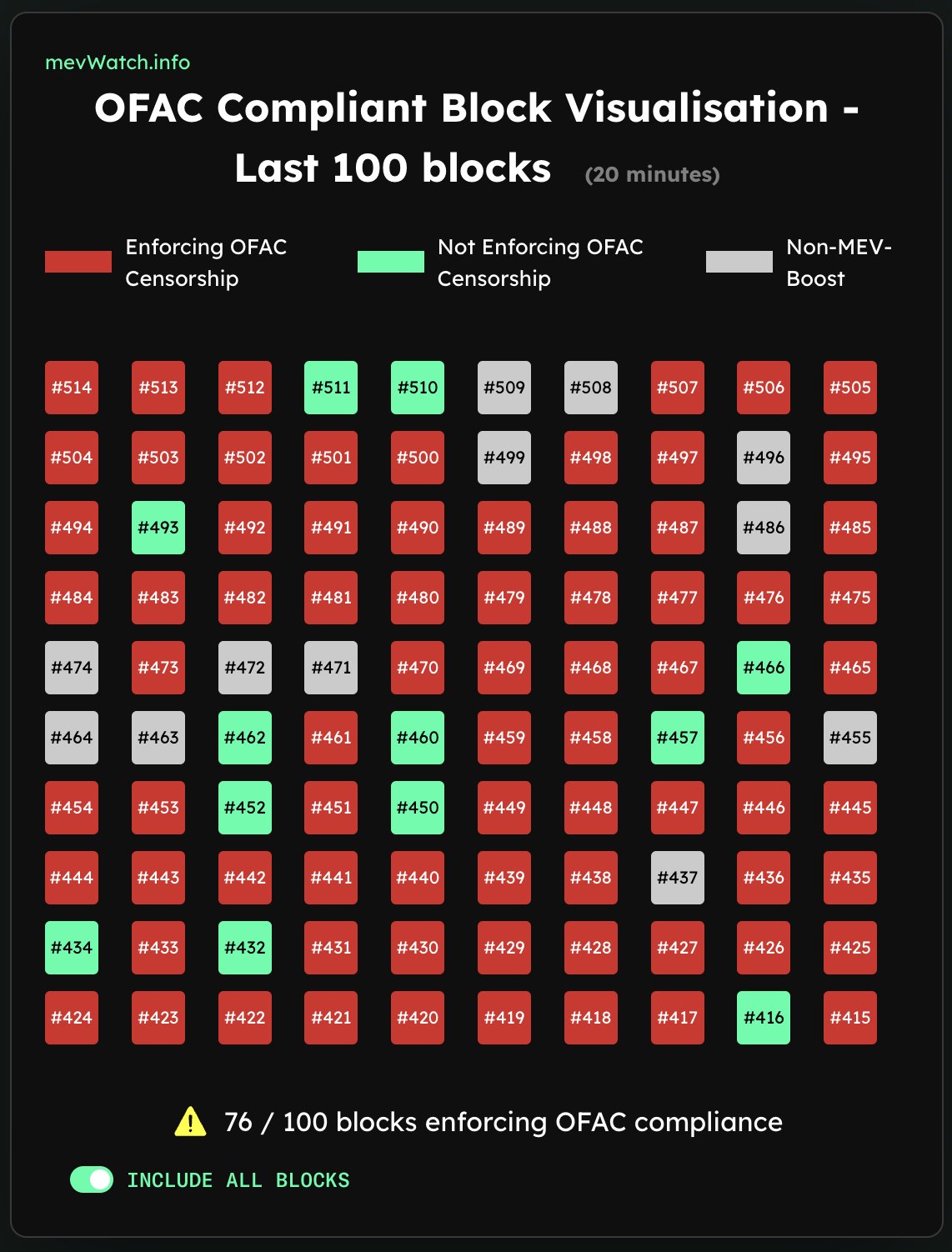

This is the context for the screenshots you've been seeing. Those incredibly scary graphics that make it look Ethereum has been forever compromised by the US Government.

No one wants to accept a transaction from a wallet that touched Tornado Cash.

Look - I get it. If >75% of transactions are being censored off of one stupid sanction, is Ethereum doomed?

I don't know the objective truth, I can only give you my personal perspective...

...but I emphatically believe that this just isn't that big of a deal.

Reasons to Believe

At this point it's time to draw this thread to a conclusion; we'll need to talk through what all of this really means in future threads.

But let's walk very quickly through some of the reasons to think this will all work out.

- First, it's important to think about what that red-square-chart-of-death is actually showing. It's saying "x% of blocks came from block builders/relays that say they will comply with the OFAC shitlist," not "of all the transactions that are pending, x% were censored."

- Second, think about how transactions work; specifically the market dynamics behind the priority fee/tip. Let's say Alice REALLY needs to push a transaction through ASAP. All she needs to do is increase the fee until a it creates a block more lucrative than one that's "censored."

- Third, let's say Alice wont increase her fee, but she can wait. If 75% of blocks are censored, she can only get her txn in in one in every 4 blocks. So, instead of waiting for 12 secs, she must wait 48. Censorship increases to 99%? She just needs to wait ~20 mins.

- Finally, there are mitigations that can be built directly into the protocol. The most promising solution (IMO) is implementing the Forward Inclusion List (aka crList). Tl;dr the proposer can tack on txns after the selecting a prebuilt block.

In conclusion, while US Treasury did its best to ruin Ethereum with the Tornado Cash sanctions, it will be unsuccessful.

First, because of the market dynamics of a decentralized network.

Second, because the community will outbuild them.

Ethereum is inevitable.

Resources

Source Material - Twitter Link