Discounted Cash Flow Analysis

Time-Value of Money

Consider the following two investments:

- Bond A that pays $100 in 1 week

- Bond B that pays $200 in 1 year

Investments require dedicating and tying up capital; you must make a choice. How do you decide which is the better investment? This type of analysis is tricky because you have to measure both $ value and when it actually pays out.

Bond A pays less than Bond B, but it pays much quicker. You would have 51 weeks to use your $100. Maybe buy $ETH?

Who knows it might 10x in a year (🫣).

Definition

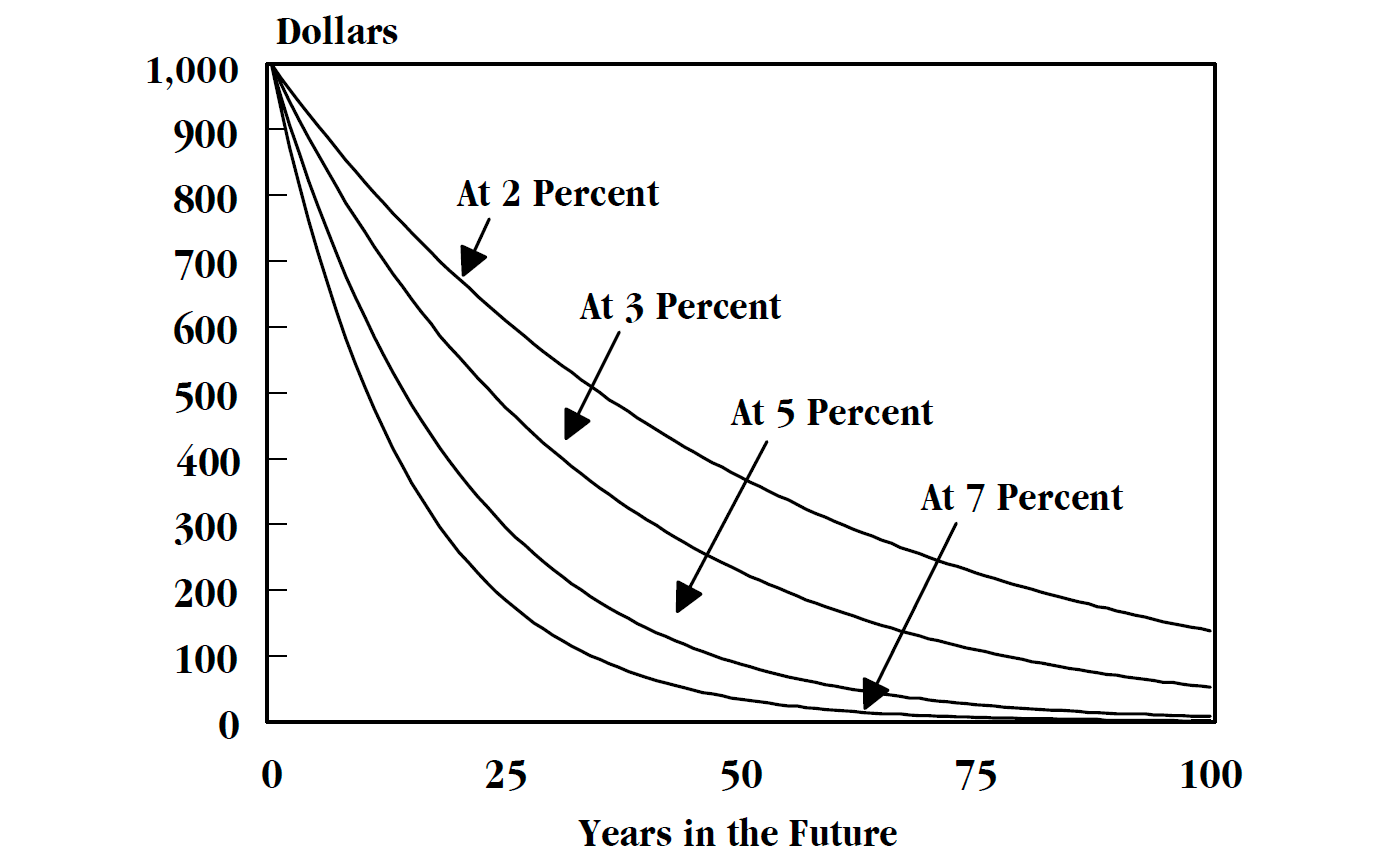

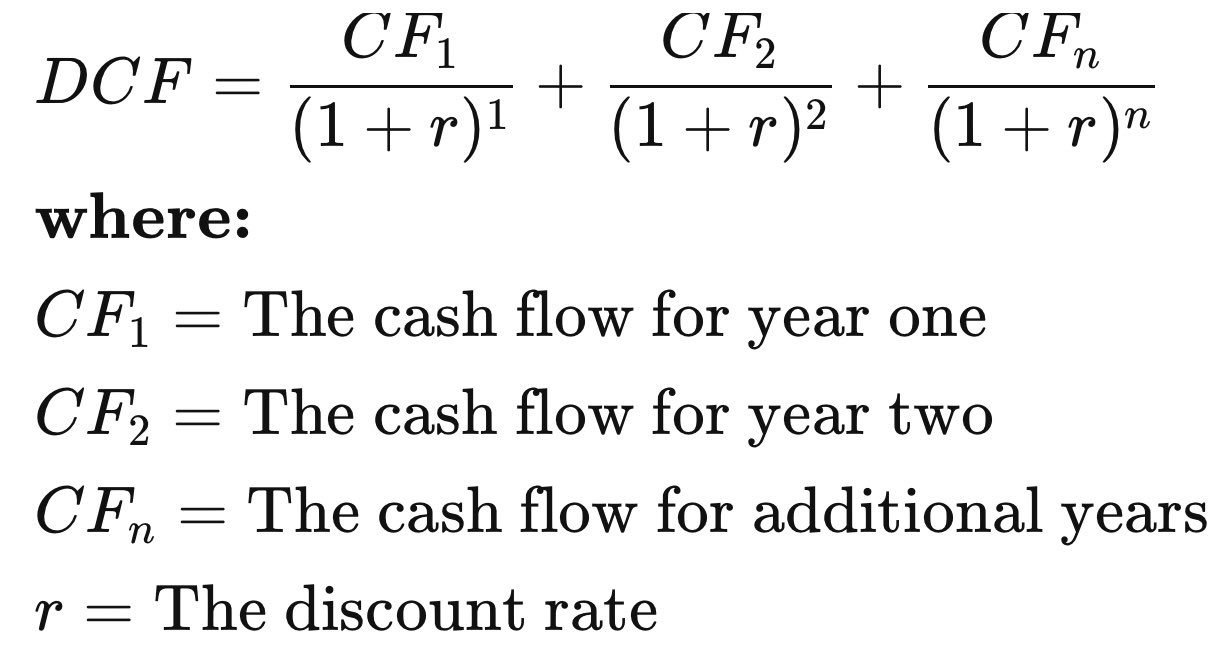

Discounted Cash Flow (DCF) analysis is a method of valuing cash flow that analyzes future value as if it existed today. Let’s walk through the formula:

DCF = CF / (1+r)^t

DCF is (usually) measured in Present Value (PV) or Net Present Value (NPV). These metrics express the time-value of money, and can be thought of as “if I had my future cash flows today, the Present Value would be $X.”

DCF = NPV = CF / (1+r)^t

Discount Rate

Interest/Discount Rate (r) is the cost of dedicating capital towards the future payoff. Specific to each individual applying DCF, it expresses the costs to be in an investment. These costs generally come from two categories:

- Financing Costs

- Opportunity Costs

Financing Costs

Let’s say you have 100 $ETH that you want to hodl forever, but just saw that Yuga Labs is launching ApeMutantBoredYachtKennelClub and you want in.

Now you need 20 $ETH.

Rather than trading away your $ETH, you could turn to Aave and take a loan. Every month the loan is active, you’ll pay ~2% in interest.

Therefore, (part of) your discounting rate (the cost of tying up capital in your new NFT) is ~2%/year.

Opportunity Costs

You still have 100 $ETH and want that NFT, but you’re ok selling some $ETH. However, your $ETH can be staked and earn ~4%; sell it and you can’t get that yield.

Therefore, (part of) your discounting rate (missed opportunity of staking) is ~4%/year.

Analysis

Building a bespoke discounting rate is the secret sauce of DCF analysis.

Every investor has different borrowing costs, alternate opportunities, flexibility needs, etc. The formula will pop out a number no matter what you put in, it’s up to you to build the right inputs.

Once you figure it out, DCF analysis is incredibly powerful. It allows you to collapse every cash flow, regardless of duration or time in the future, into a single metric.

With a single metric and an apples-to-apples comparison, investing becomes much less of guesswork.

DCF is one of those fundamentals that transcend investment class.

As you become a more sophisticated crypto investor, make sure you spend time learning the basics; you’ll not only become a better investor, but we’ll create a better, more stable market.

Resources

Source Material - Twitter Link