¶ mev-boost

¶ Prerequisites

¶ Prereq 1

Lorem ipsum

¶ The World Computer

Ethereum is the World Computer, a network of 1,000s of computers (nodes) coordinating using Proof of Stake (PoS) to keep the Ethereum Virtual Machine (EVM) in sync.

The EVM is the shared computing platform, the blockchain its history and ETH its lifeblood.

This "network of nodes" is the foundation upon which Ethereum ultimately derives its value. The more decentralized, the more value.

From decentralization comes credible neutrality.

Without credible neutrality, we might as well be using FB-dollaroos in Farmville-DeFi.

¶ Proof of Stake

PoS is a huge topic, here's what you need to know for this thread:

- a block is a bundle of transactions, which are executed in the EVM

- users send pending transactions to the mempool

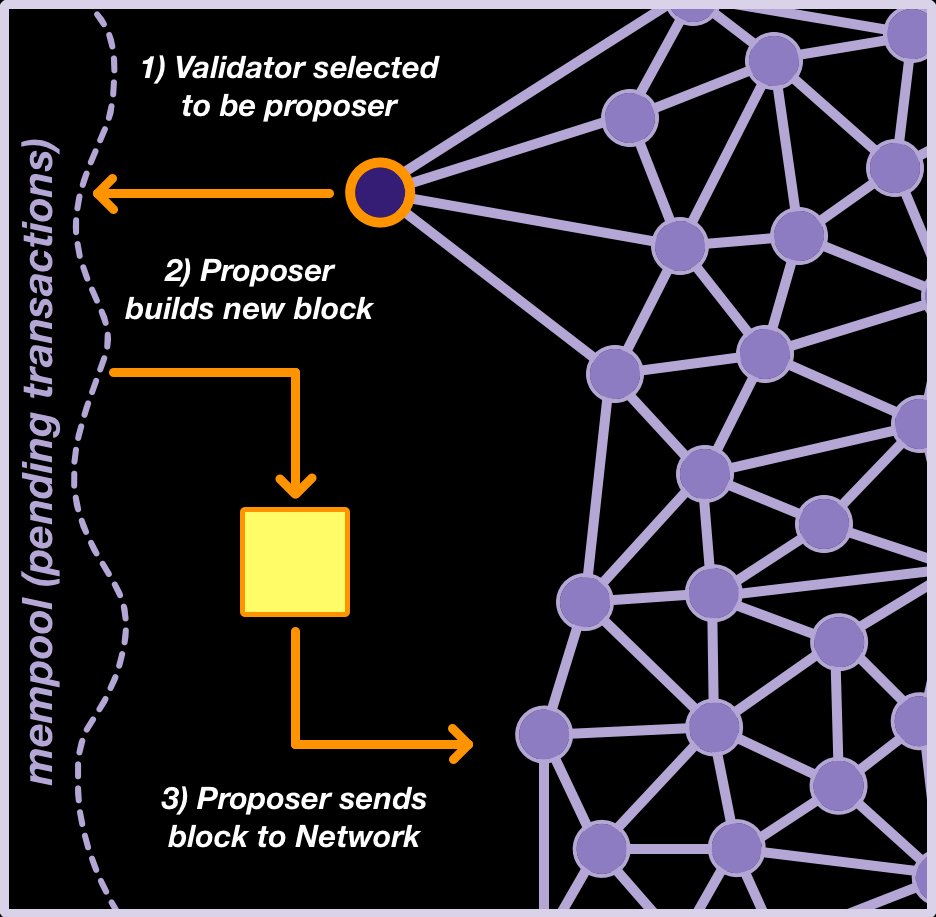

- once per slot, a validator is randomly selected to be a block proposer

The way it works at the protocol level is simple: the proposer builds its own block.

The vast majority of proposers will simply go down the pending transaction list until their block fills up…

...but some are making better decisions, thereby making huge profits.

¶ Maximum Extractable Value

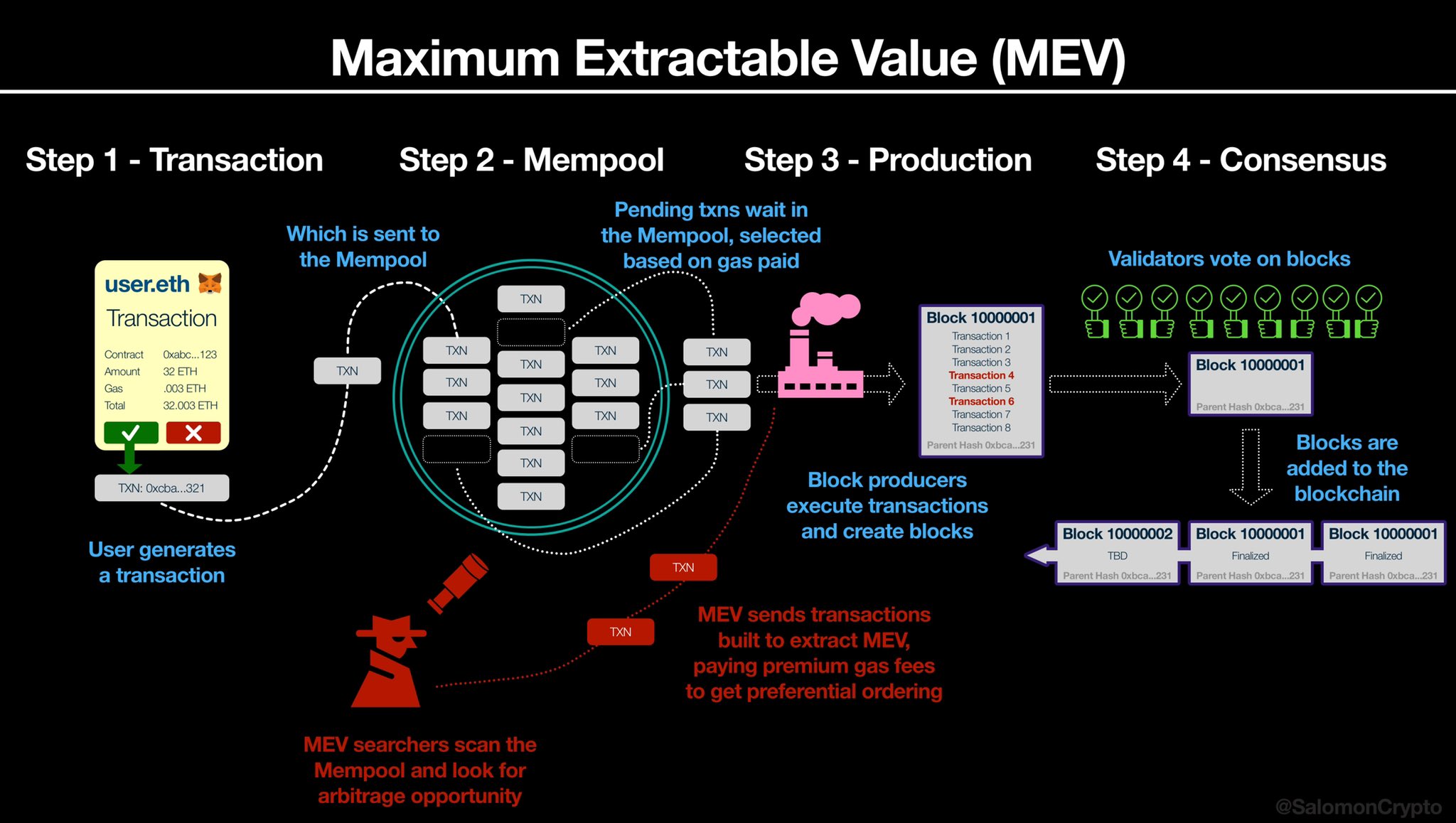

MEV stands for Maximum Extractable Value, and represents the general principle that there is monetary value that can be extracted from the having special information, access or privileges in a system.

In Ethereum, the block builder controls the vast majority of MEV.

Here's a simple example. Let's say Alice wants to sell 100,000 ETH and Bob wants to buy 1 ETH. Alice's order is so large that it will move the price of ETH.

If the builder puts in Bob's order before Alice's, Bob will get significantly less ETH than if it goes after.

A sophisticated block builder can do many things to profit from this scenario:

- take a higher tip from Bob to execute his transaction first

- create and process a transaction to sell some of its own ETH before Alice

- create and process a transaction to buy more ETH back at a lower price

There is a big incentive to become good at block building.

The better you understand the mempool (and the better access to private order flow), the more you will earn from your staked $ETH.

And herein lies the problem: left unchecked, MEV will centralize Ethereum.

¶ The Centralization Power of MEV

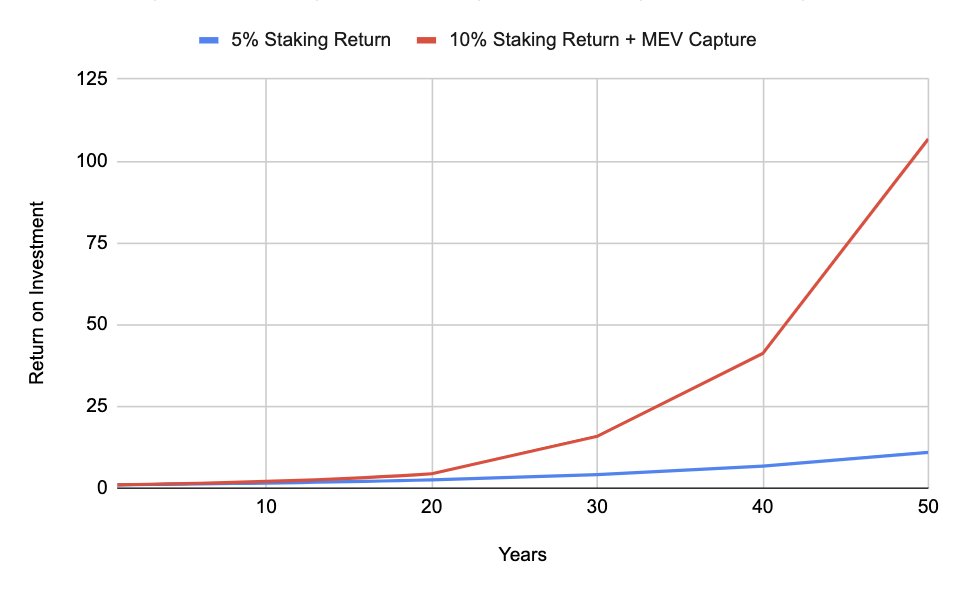

The problem is that over time, the impact becomes bigger and bigger.

This is the nature of compound interest, the eighth wonder of the world.

Left unchecked, the best block builders will capture more and more ETH, and eventually Ethereum.

From decentralization flows credible neutrality.

From credible neutrality flows the value of ETH.

¶ Flashbots

In November 2020, Stephane Gosselin posted "Flashbots: Frontrunning the MEV crisis" and introduced the community to Maximum Extractable Value (MEV).

Even before the Merge was complete and Ethereum finally switched to PoS, we already had a temporary solution up and running (and a full solution in the works).

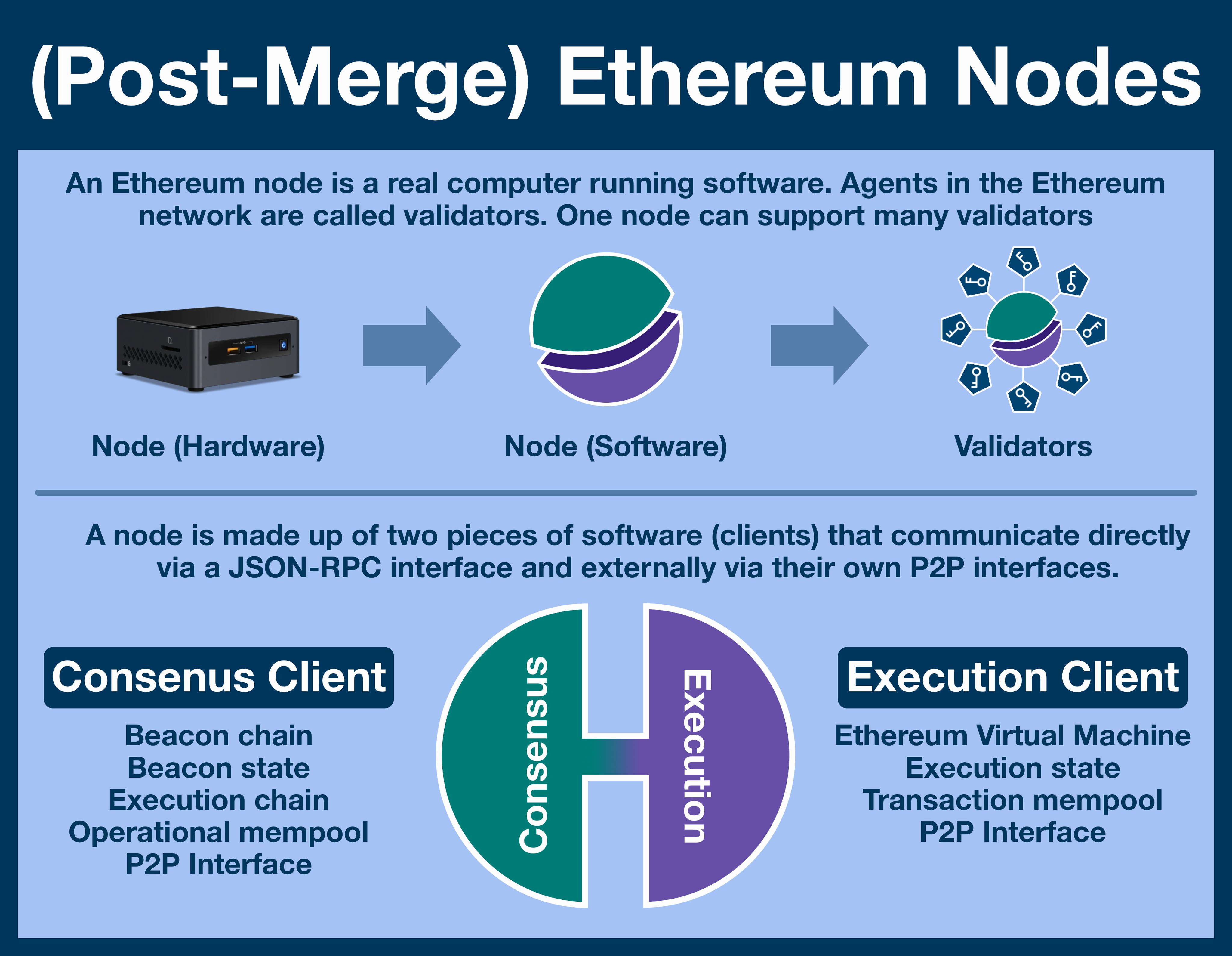

¶ Ethereum Nodes

A node is a computer that runs two pieces of software, an execution client (managing the EVM) and a consensus client (managing PoS).

¶ MEV-Boost

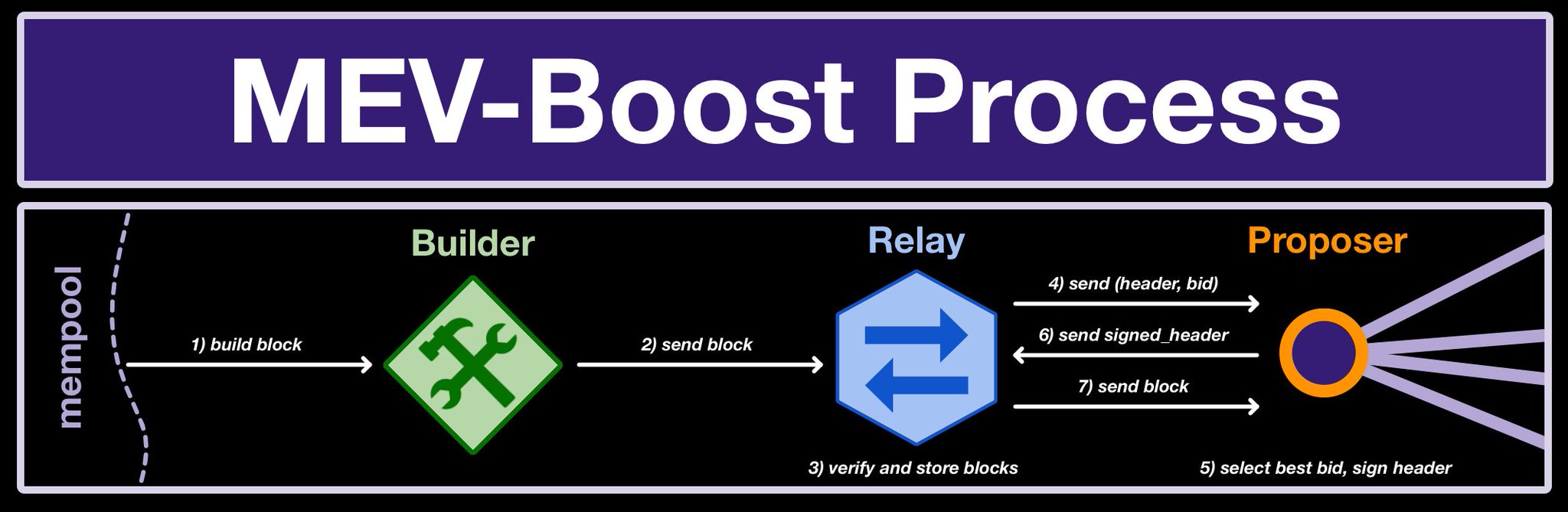

MEV-Boost is an extra piece of node software that gives it the ability to source blocks from a block relay.

The node will always be able to build blocks itself, but it can look at headers and take blocks from specialized block builders...

...builders who will pay to be picked.

Think about our example. Say a block builder knows Alice is going to move the market and can calculate that by selling before and buying back after, he can lock in an extra 50 ETH.

He might be willing to bid up 49 ETH to be picked, as he will still lock in a profit.

The purpose of this system is to disassociate the difficult, knowledge/capital/experience-heavy work of building blocks with the financial rewards for proposing them.

Every proposer can share in the returns offered by MEV simply by picking the best bid during their slot.

¶ Remaining Trust Assumptions

MEV-Boost is an incredible product and a huge step in decentralizing Ethereum, but MEV-Boost is not perfect.

In order to understand why, we need to dig a little deeper into how MEV-Boost actually works (not too deep).

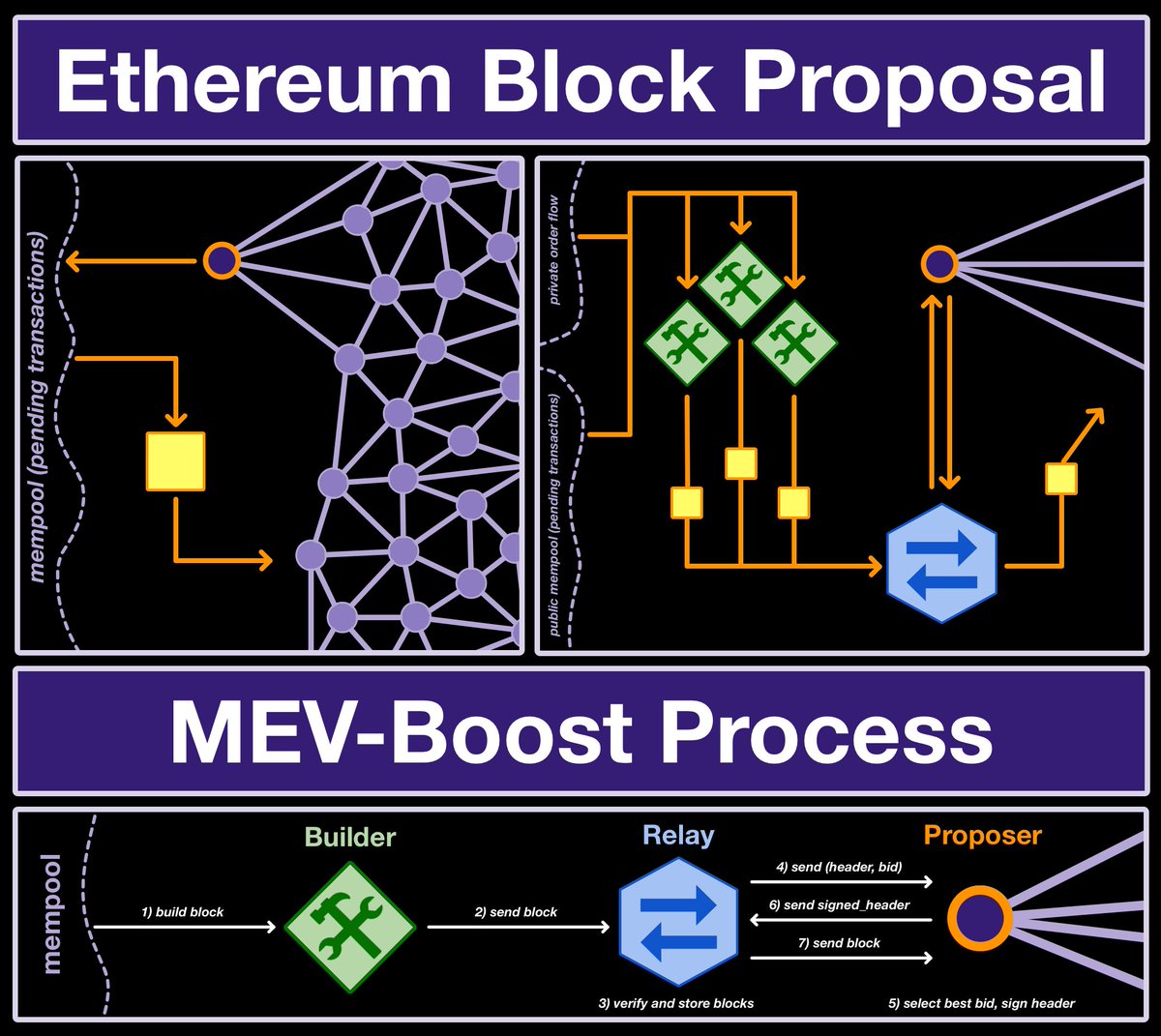

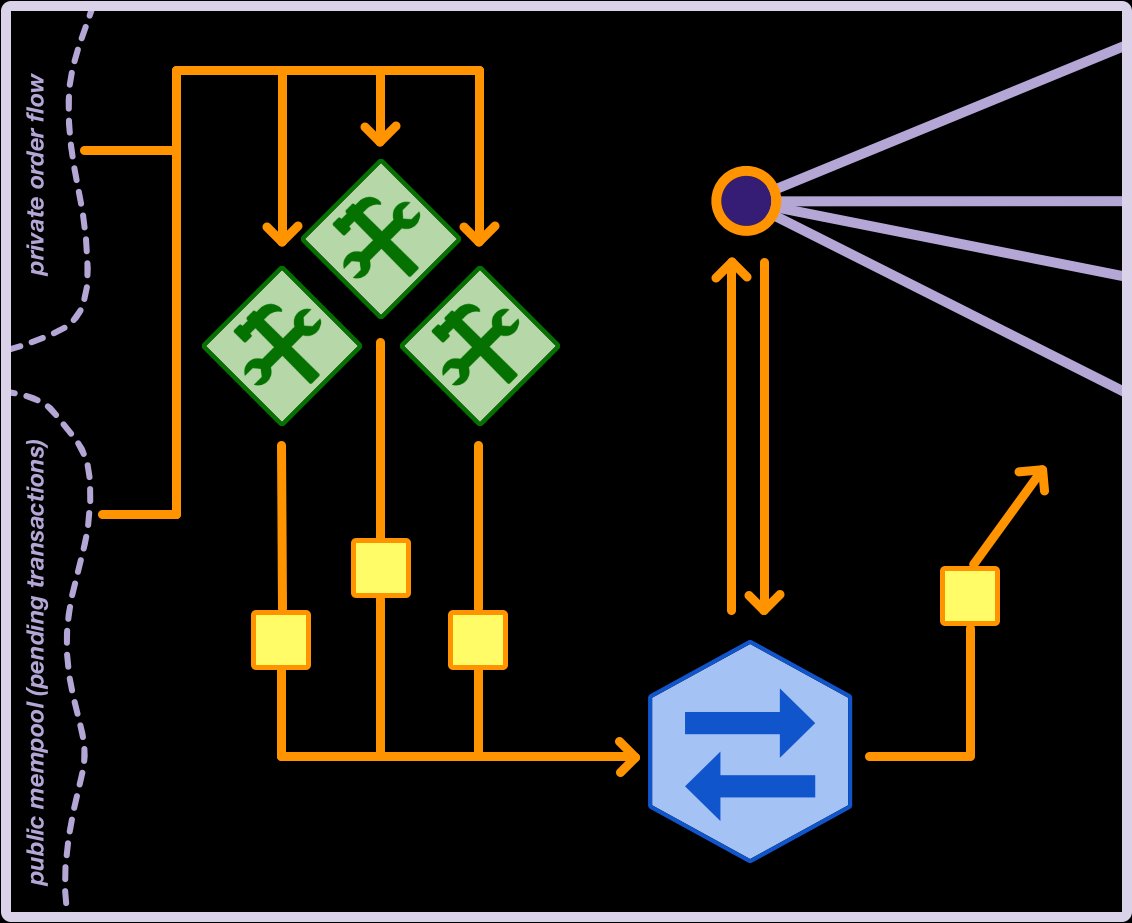

First, we must introduce ourselves to the three players:

- Builders, responsible for crafting the most profitable blocks possible for each slot.

- Relays, responsible for acting as the intermediary.

- Proposers, which are the Ethereum validators proposing the block.

The problem with MEV-Boost is the relay, an entity that has to be trusted not only by the builder but also by the proposer.

The builder must trust that the relay will keep his block secret until after the proposer has paid the builder's fee.

The proposer has to trust that the relayer has confirmed the block and the bid are valid, without being allowed to see the underlying transactions.

The former is particularly important, as an invalid block will result in slashing.

¶ Trustless Solutions

Fortunately, we have solutions; we'll briefly discuss two.

But I want to take a moment to recognize that while MEV-Boost isn't perfect, it's a HUGE leap forward.

With MEV-Boost, ALREADY plug-and-play node operators (like myself using Rocket Pool) are experiencing MEV yields.

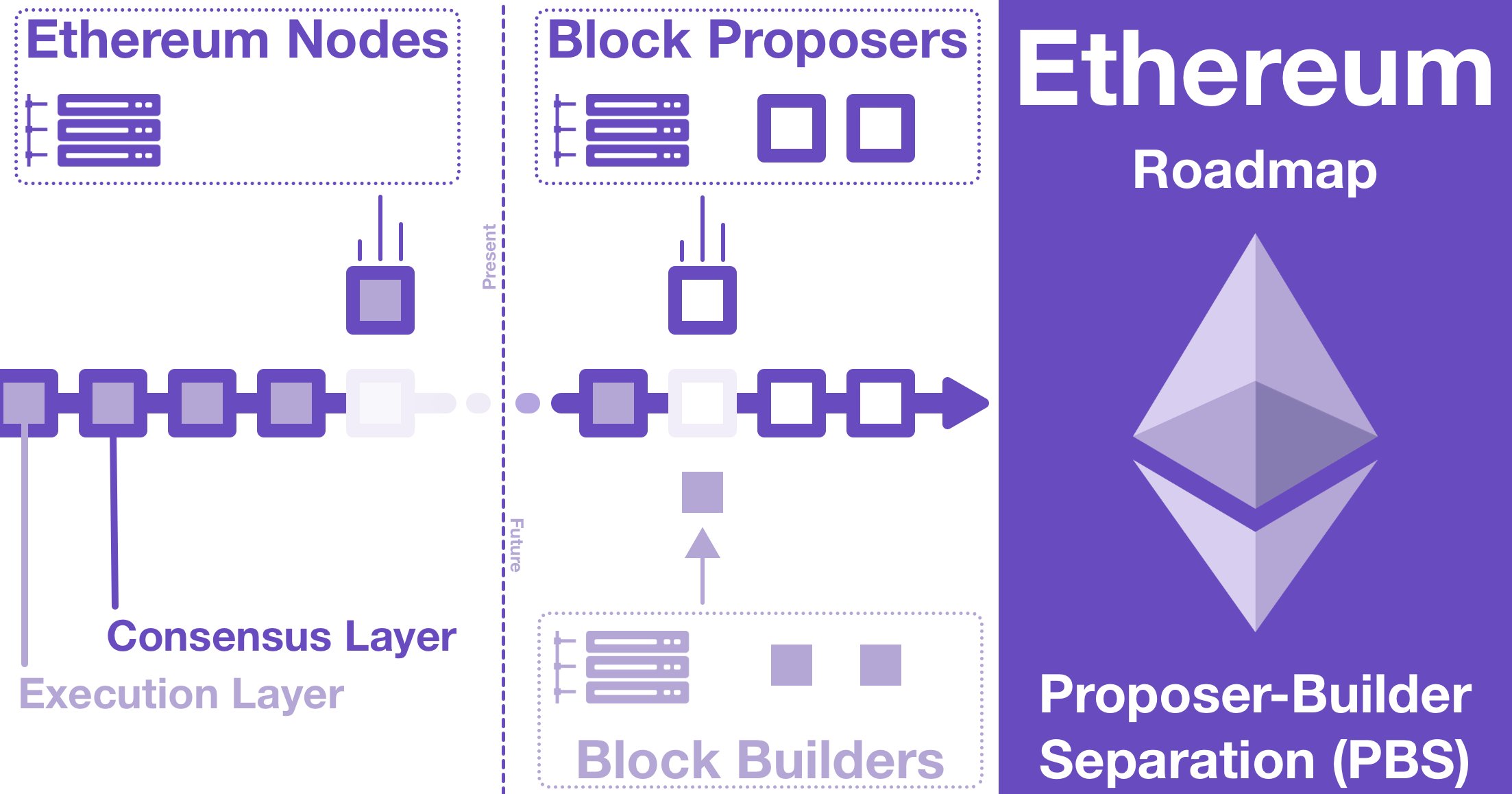

¶ Protocol Enshrined Proposer-Builder Separation

Deep Dive: Protocol Enshrined Proposer-Builder Separation

The first solution is to add the concept of MEV-Boost and into the core Ethereum protocol.

This would remove the need for relays and allow us to cryptographically verify everything without leaking blocks early.

We call this idea Enshrined Proposer-Builder Separation.

¶ EigenLayer

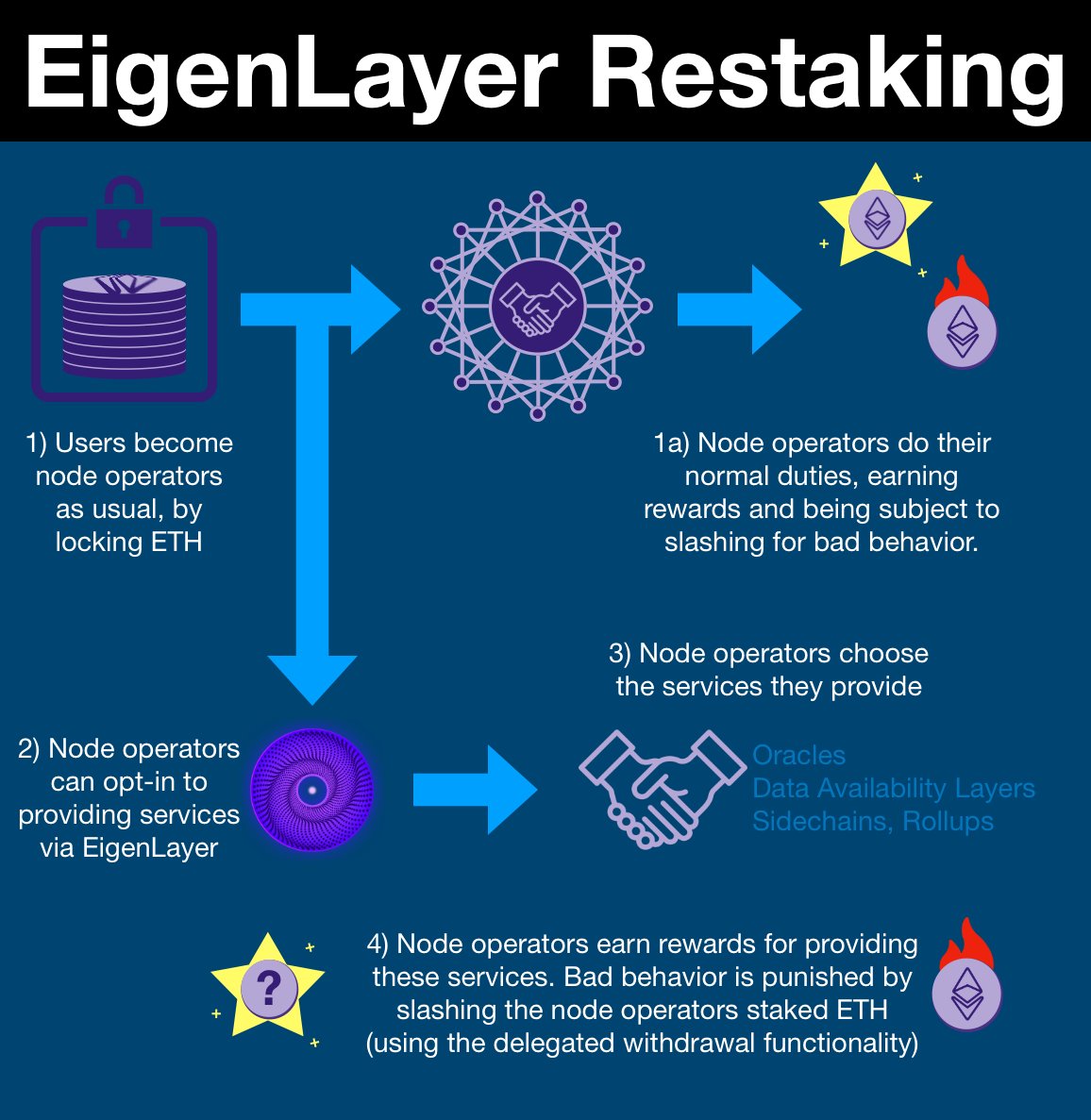

A second idea, proposed by Sreeram Kannan, leverages new ideas about the nature of $ETH to transform the trusted components of MEV-Boost into untrusted systems secured by Ethereum.

¶ crList

Both of these solutions require some modifications of the MEV-Boost model.

Most importantly, MEV-Boost risks a market of block builders that censor transactions (for whatever reasons).

Fortunately, there are lots of good ideas for solutions.

But let's not get too far ahead of ourselves; we are barely post Merge.

There is a lot more to build before we move on from MEV-Boost.

¶ Resources

Source Material - Twitter Link

Source Material - PDF